- GBP/USD has broken below a long-term ascending trendline, signaling potential further downside.

- UK budget concerns and a drop in manufacturing PMI have contributed to the Pound’s struggle.

- UK budget concerns and a drop in manufacturing PMI have contributed to the Pound’s struggle.

Cable has struggled this week following the UK budget. Pound Sterling should have appreciated against the greenback considering the paring back of rate cut expectations from the Bank of England (BoE).

Following the UK budget expectations for the Bank of England to lower interest rates have dropped. This change came after the UK Chancellor announced the biggest tax increase since 1993, worth 40 billion pounds, along with plans to increase government spending and investment by raising the fiscal deficit. Additionally, the Office for Business Responsibility predicted higher inflation rates of 2.5% in 2024 and 2.6% in 2025, leading traders to reduce their bets on rate cuts by the Bank.

There are some other concerns around the UK budget which was raised by Moodys as well and could explain the British Pounds struggle. There are concerns that the added borrowing will impact the UKs ability to bring their finances in order. Moodys also stated that the UK budget creates challenges and cautioned that we could see muted growth from the UK moving forward.

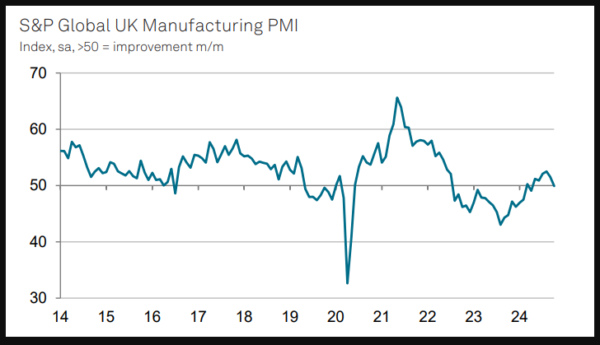

The continued selloff in the US Dollar was not enough to arrest the slide in GBP/USD before a bounce occurred this morning. The release of the S&P Global Flash UK Manufacturing PMI dropped to 49.9 in October 2024, down from 51.5 the previous month. This was lower than expected and shows the first drop in factory activity since April. New orders decreased as clients waited for the UK budget.

Orders from abroad also fell for the 33rd month, with fewer orders from Europe, China, and the US. Production increased slightly as factories worked through their backlog of orders. Manufacturing jobs grew for the third time in four months, but more slowly because of fewer new orders. Costs for materials dropped to their lowest in ten months, and selling prices went up the least since February. Business optimism improved a little from a nine-month low in September. The data however appeared to have little impact on GBP/USD ahead of the US session

Source: FinancialJuice (click to enlarge)

A batch of US data awaits later in the day with the US jobs report chief among them. Markets are anticipating a strong number following labor data seen earlier in the week and should this come to pass, it will be interesting to gauge if cable can shrug off the US data and continue its move higher today.

GBP/USD Technical Analysis

GBP/USD is now at an interesting place as it has broken below the long-term ascending trendline which began back in April.

This trendline break opens up a host of scenarios and potential opportunities in cable moving forward. I could see a retest of the trendline developing before a continuation of the move lower with a deeper pullback to the 1.300 handle also a possibility.

Any such pullback may be preferred for any would-be-shorts looking to get involved. A break and daily candle close above the 1.30150 handle would invalidate the bearish setup.

Looking at the downside, support rests at the 200-day MA around 1.2800 before the 1.2750 and 1.2681 handles come into focus.

GBP/USD Daily Chart, November 1, 2024

Source: TradingView.com (click to enlarge)

Support

- 1.2845

- 1.2800

- 1.2750

Resistance

- 1.2942

- 1.3000

- 1.3033