Key Highlights

- AUD/USD gained bearish momentum below the 0.6750 support.

- A connecting bearish trend line is forming with resistance at 0.6690 on the 4-hour chart.

- Gold prices rallied to a new all-time high at $2,758 before it saw a minor pullback.

- EUR/USD declined further and traded below 1.0800.

AUD/USD Technical Analysis

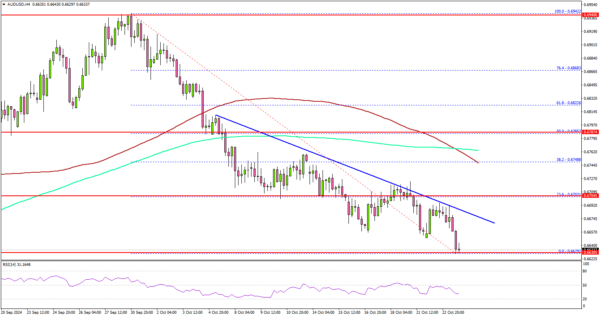

The Aussie Dollar started a fresh decline below the 0.6800 level against the US Dollar. AUD/USD traded below 0.6750 to move into a bearish zone.

Looking at the 4-hour chart, the pair settled below the 0.6720 pivot level, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour). The pair even tested the 0.6630 level and currently consolidating losses.

On the upside, the pair could face resistance near the 0.6685 level. There is also a connecting bearish trend line forming with resistance at 0.6690 on the same chart.

The first key resistance is near the 0.6750 level and the 100 simple moving average (red, 4-hour). A close above the 0.6750 level could set the tone for another increase. The next major resistance could be 0.6800, above which the price could accelerate higher toward the 0.6840 level.

On the downside, immediate support sits near the 0.6620 level. The next key support sits near the 0.6600 level. Any more losses could send the pair toward the 0.6550 level.

Looking at EUR/USD, the pair followed a bearish path and the bears were able to push the pair below the 1.0800 level.

Upcoming Economic Events:

- Euro Zone Manufacturing PMI for Oct 2024 (Preliminary) – Forecast 45.1, versus 45.0 previous.

- Euro Zone Services PMI for Oct 2024 (Preliminary) – Forecast 51.6, versus 51.4 previous.

- US Manufacturing PMI for Oct 2024 (Preliminary) – Forecast 47.5, versus 47.3 previous.

- US Services PMI for Oct 2024 (Preliminary) – Forecast 55.0, versus 55.2 previous.

- US Initial Jobless Claims – Forecast 242K, versus 241K previous.