Oil price extends steep decline into the second consecutive day and hit two week low in early Tuesday, after the price fell nearly 4% on Monday.

Oil was deflated by weaker demand outlook and signals that Israel will not strike Iranian oil infrastructure.

OPEC cut its forecast for global oil demand in 2024, which increased pressure on oil prices, but negative impact is likely to be partially offset by heated geopolitical situation and permanent threats of further escalation.

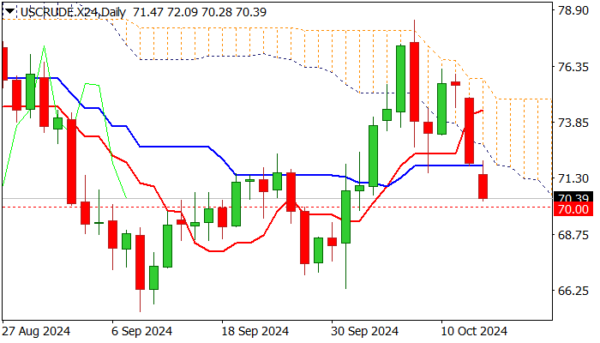

Oil price fell near psychological $70 support, where bears may face increased headwinds, as 14-d momentum is attempting to reverse north just above the centreline and stochastic is about to probe into negative territory.

Pause at $70 level looks like possible scenario, although near-term bears will remain in play while potential upticks hold below (daily cloud base / Kijun-sen ($71.89) and offer better selling opportunities.

On the other hand, firm break through $70 pivot would signal bearish continuation and expose targets at $66.33 (Oct 1 low) and $65.26 (2024 low posted on Sep 9).

Res: 70.74; 71.89; 72.69; 73.70.

Sup: 70.00; 69.30; 68.37; 66.33.