- USDJPY makes an attempt for steeper bullish actions

- MACD and RSI confirm upside momentum

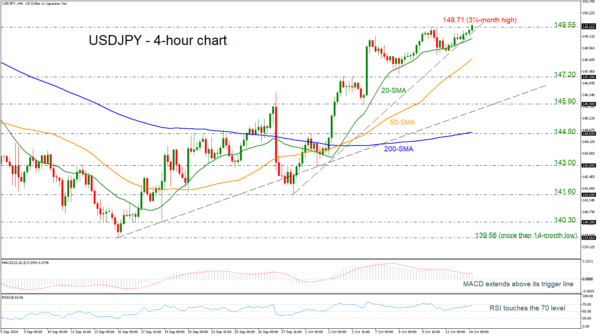

USDJPY is rising towards a fresh three-and-half-month high of 149.71, posting the fifth consecutive green 4-hour session. The next strong battle likely awaits at the 150.00 psychological level, but the next resistance lies at the 151.90 level, taken from the inside swing low on July 25. But first, the price needs to overcome the 200-day simple moving average (SMA), which is at 151.20.

Otherwise, a decline beneath the steep short-term uptrend line and the 20-period SMA at 149.00 could take the bears until the 50-period SMA at 148.05. Even lower, traders may flirt with the 147.20 support level before returning to the medium-term ascending line at 145.90.

Technical oscillators show some bullish signs. The MACD is extending its positive momentum above its trigger and zero lines, while the RSI is heading north near the 70 level.

All in all, USDJPY is creating a notable upside movement, trying to endorse the short-term bullish structure. A fall beneath the 200-period SMA at 144.50 could switch the outlook to negative.