- USDCHF finds fresh buying near 50-day SMA; rises to six-week high

- Short-term outlook remains positive, but a pullback cannot be ruled out

- US CPI inflation data may create fresh volatility at 12:30 GMT

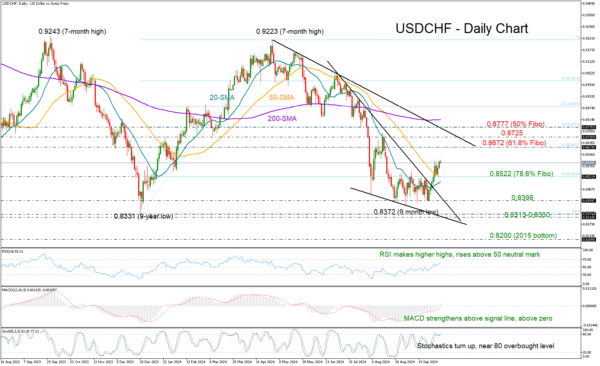

USDCHF secured strong footing near 50-day simple moving average (SMA) and extended its bullish break out of the monthly range to a six-week high of 0.8609 on Wednesday.

Despite the current weak price momentum, the technical indicators suggest there could be more bullish potential. With the RSI extending its uptrend above its 50 neutral mark and the MACD entering the positive region for the first time since May, the short-term bias is now favoring the upside. Yet, with the stochastic oscillator hovering near its 80 overbought level, some stability cannot be ruled out.

Resistance is anticipated around the 61.8% Fibonacci retracement level of 0.8672 if the pair continues its bullish wave. Further up, the August bar of 0.8725 could keep the bulls busy, delaying any increases towards the descending trendline and the 50% Fibonacci mark of 0.8777.

On the downside, the positive bias could be maintained if the 78.6% Fibonacci level of 0.8522 and the 50-day SMA put a floor under the price. If they concede and the price dips below its 20-day SMA, the spotlight will turn straight to the 0.8398 bottom. A steeper decline may threaten a broad outlook deterioration below the nine-year low of 0.8330 and the 0.8313 barrier. The 0.8200 round mark could come on the radar next.

All in all, USDCHF seems to be holding a bullish bias in the short-term picture after exiting its recent horizontal trajectory. Unless the price tumbles below 0.8522, a bearish action shouldn’t be a concern.