Key Highlights

- USD/JPY started a decent increase above the 142.50 resistance.

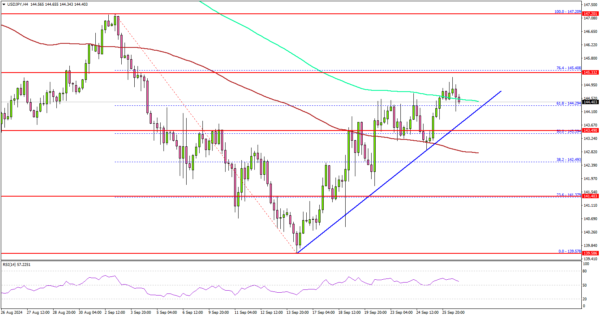

- A key bullish trend line is forming with support at 144.00 on the 4-hour chart.

- Oil prices started another decline from the $73.50 resistance zone.

- Bitcoin might aim for more gains above the $65,000 level.

USD/JPY Technical Analysis

The US Dollar found support near 139.60 against the Japanese Yen. USD/JPY formed a base and started a fresh increase above 141.20.

Looking at the 4-hour chart, the pair climbed above the 142.50 and 1.3400 levels. It even settled well above the 100 simple moving average (red, 4-hour) and the 200 simple moving average (green, 4-hour).

There was a clear move above the 61.8% Fib retracement level of the downward move from the 147.20 swing high to the 139.57 low. On the upside, the pair now faces hurdles near the 145.40 zone.

The 76.4% Fib retracement level of the downward move from the 147.20 swing high to the 139.57 low is also near 145.40. A clear move above the 144.40 and 144.50 levels might set the pace for a move toward 145.50. Any more gains might call for a test of the 146.20 zone.

On the downside, immediate support sits near the 144.20 level. There is also a key bullish trend line forming with support at 144.00 on the same chart, below which the pair might test 143.50.

The next key support sits near the 142.80 level and the 100 simple moving average (red, 4-hour). Any more losses could send the pair toward the 142.00 support zone.

Looking at Oil, there was a fresh bearish wave from $73.50 and the bears seem to be back in action.

Upcoming Economic Events:

- US Personal Income for August 2024 (MoM) – Forecast +0.4%, versus +0.3% previous.

- US Core Personal Consumption Expenditure for August 2024 (MoM) – Forecast +0.2%, versus +0.2% previous.