- USD/JPY failure to have a clear break below 140.25 coupled with BoJ Governor Ueda’s cautious rhetoric has increased the odds of a mean reversion rebound.

- A swift increase in large speculators’ net bullish open positioning in the JPY futures market to a 5-year high makes the USD/JPY vulnerable to a short squeeze.

- Watch the key medium-term resistance zone of 146.90/149.30 on the USD/JPY.

Before last Friday, 20 September Bank of Japan’s (BoJ) monetary policy decision, the USD/JPY weakened and hit the first medium-term support level of 140.25 on 16 September as highlighted in our prior report.

Hawkish BoJ monetary policy statement toned down by cautious rhetoric from Ueda

BoJ has left its overnight policy interest rate unchanged at 0.25% as expected and its monetary policy statement has been peppered with a lukewarm hawkish tone. It stated that inflationary expectations have heightened moderately, consumption is rising moderately, and economic growth in Japan is likely to achieve growth above potential.

These liners suggest that BoJ is on track to resume its normalization policy by likely another rate hike of 25 basis points in either October or December.

However, during the press conference, BoJ Governor Ueda offered a contrasting guidance where he surprisingly sounded less hawkish, stating that the upside risk to inflation from the recent Japanese yen’s weakness has eased, and BoJ is not in a stage to immediately hike rates immediately due to a lack of clarity in the economic growth conditions of the US.

The cautious rhetoric from Ueda has reduced the odds of another rate hike by BoJ in 2024, and pricing in the short-term interest rate swaps market has indicated only a 30% chance of a 25 bps increase in the December monetary policy meeting.

The USD/JPY has rallied by 1.95% from last Friday, 20 September Asian session intraday low of 141.74 to print a US session high of 144.50 on the same day.

Overstretched net bullish positioning in JPY futures

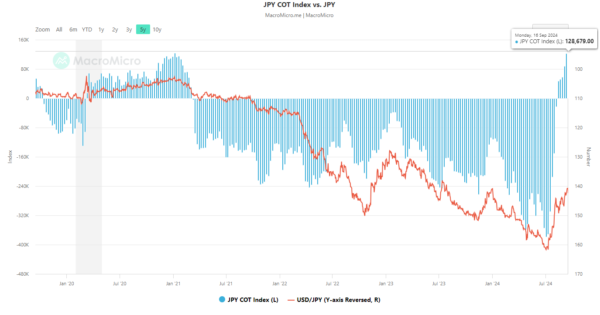

Fig 1: Commitments of Trader large speculators’ net positioning in JPY futures as of 16 Sep 2024 (Source: Macro Micro, click to enlarge chart)

Based on the latest data Commitments of Traders data as of 16 September 2024 (compiled by Macro Micro), the aggregate net bullish open positions of large speculators in the JPY futures market (after offsetting the aggregate positions of large commercial hedgers) have risen to +128,679 contracts (net long), a significant increase of 176% in the past six weeks to hit a 5-year high after being net bearish open positioning for almost three years (see Fig 1).

Given that net open large speculative positioning flows (primarily from hedge funds) are contrarian in nature which suggests that a relatively high level of net positioning may see an opposite reaction in price actions if related data or news flows disappoint.

In the context of USD/JPY price action movements, the risk of an adjustment (short-squeeze) to such high levels of yen bullish open positioning cannot be ruled out as large leveraged speculators have committed a relatively high amount of net bullish open positions.

Hence, the USD/JPY now faces an increased risk of a rebound after it declined by 13% from its July high of 161.95 in the past 11 weeks.

Technical analysis suggests a potential mean reversion rebound

Fig 2: USD/JPY medium-term trend as of 23 Sep 2024 (Source: TradingView, click to enlarge chart)

Last week’s price actions of the USD/JPY have probed a significant key swing low of 140.25 formed on 28 December 2023. It failed to break below it on last Monday, 16 September, and staged a daily close above the 20-day moving average at 143.92 last Friday, 20 September (ex-post BoJ).

In addition, the daily RSI momentum indicator has flashed out a bullish divergence condition at its oversold region which suggests the prior medium-term downside momentum from 11 July to 16 August has eased (see Fig 2).

These observations suggest a possible mean reversion rebound at this juncture that may revisit the key medium-term resistance zone of 146.90/149.30 (also the downward-sloping 50-day moving average).

On the flip side, a breakdown with a daily close below 140.25 may resume the downward trajectory to expose the next medium-term supports at 137.35 and 133.75.