USDJPY jumped over two figures on Friday after Bank of Japan kept interest rates unchanged and signaled it was not in rush for further hikes, despite the borrowing cost is still very low.

Renewed attempt higher comes after Thursday’s rally of almost identical size stalled on approach to 144 barrier, with subsequent pullback contributing to daily candle with long upper shadow.

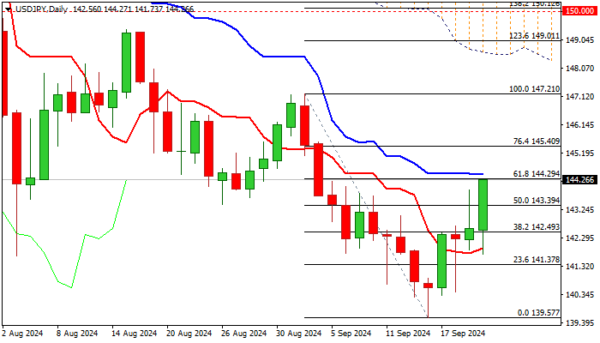

This could be a significant warning despite today’s renewed strength, as key barriers at 144.29/45 (Fibo 61.8% of 147.21/139.57/ daily Kijun-sen) need to be cleared to sideline persisting downside risk.

Daily studies point to bearish signals from still strong negative momentum, thickening descending daily cloud and overbought stochastic, partially offset by 10/20DMA’s now turning to bullish setup.

Fresh recovery is expected to keep in play while holding above broken 20DMA (143.42) though larger picture to remain biased lower as long as the price action holds below daily Kijun-sen.

Res: 144.45; 145.00; 145.40; 146.07.

Sup: 143.42; 142.49; 142.27; 142.00.