The GBPUSD pair remains in a bullish position, but signs of being overbought are emerging with the RSI indicator nearing 70. The pair has support near 1.3200 and resistance around 1.3260, with the next significant level at 1.3300. On Monday, the pair gained momentum as a weakening US Dollar and optimism around a potential Federal Reserve rate cut supported the British Pound. However, traders are holding off on large moves as they wait for important economic data, including US Retail Sales and UK inflation numbers, as well as upcoming central bank meetings. The Bank of England’s interest rate decision on Thursday is particularly in focus.

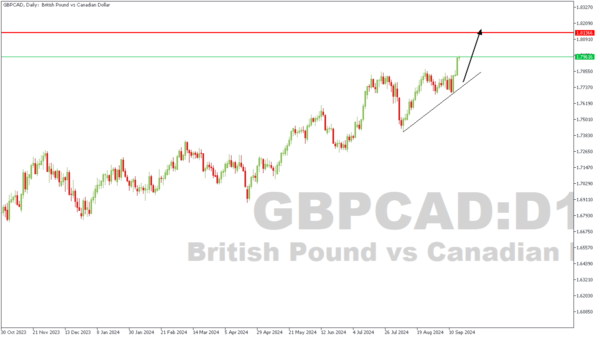

GBPCAD – D1 Timeframe

GBPCAD on the daily timeframe as seen on the Daily timeframe chart has currently bounced off the trendline support, breaking above the previous high as a result. The target for this bullish impulse in my opinion is the highlighted weekly timeframe pivot zone. In the meantime, a lower timeframe confirmation could be considered before entering the trade.

Analyst’s Expectations:

- Direction: Bullish

- Target: 1.81366

- Invalidation: 1.76810

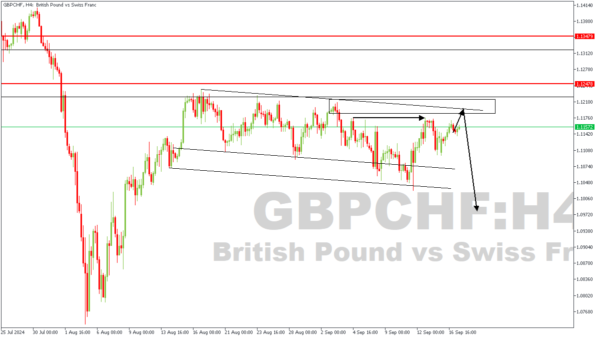

GBPCHF – H4 Timeframe

The descending channel on the 4-hour timeframe of GBPCHF is currently my target. I expect to see the highlighted high get taken out, with the trendline resistance as the initial target. This sentiment is based on the flag pattern been formed, a break above the flag should see prices reach farther into the weekly timeframe pivot.

Analyst’s Expectations:

- Direction: Bullish

- Target: 1.09800

- Invalidation: 1.12478