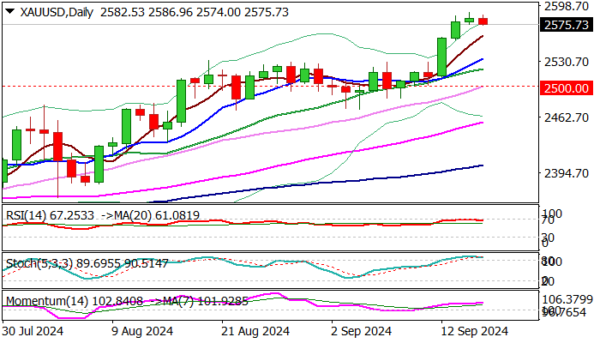

Gold price edged lower in European trading on Tuesday as bulls take a breather after hitting new record high on bullish acceleration in past three days.

Overbought daily studies contribute to a partial profit taking, but dips are likely to be shallow and positioning for fresh push higher in anticipation that Fed will cut interest rates on the policy meeting which concludes on Wednesday.

Markets are likely to reduce speed and hold in quiet mode, expecting Fed’s verdict.

Fresh rise in expectations that US policymakers will opt for more aggressive 50 basis points rate cut adds to strong bullish sentiment and favors scenario of fresh longs on shallow dips for attack at psychological $2600 and possible extension higher.

Initial supports lay at $2560/55 zone guarding more significant $2533/31 supports (10DMA / former all-time high) which should contain deeper pullback.

Res: 2589; 2600; 2614; 2628.

Sup: 2561; 2556; 2531; 2520.