- GBPUSD starts a new bearish wave but maintains broad uptrend

- Technical signals reflect appetite for more selling; eyes on 1.310b

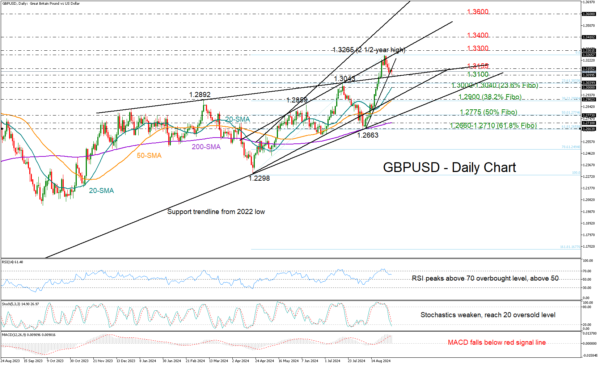

GBPUSD resumed its negative momentum during Tuesday’s early European trading hours, crossing below the steep support trendline, which had been curtailing the pullback from the two-and-a-half year high of 1.3265 over the past two trading days.

A decline below 1.3100 could motivate more selling towards the 23.6% Fibonacci retracement of the April-July upleg at 1.3040 and the 20-day simple moving average (SMA) at 1.3000. If the bears dominate there, the negative cycle could stretch towards the 38.2% Fibonacci mark of 1.2900 and the 50-day SMA. Another step lower could confirm a continuation towards the ascending trendline from 2022 seen around the 50% Fibonacci level and the 1.2775 level.

With the RSI and the stochastic oscillator changing direction to the downside and the MACD slipping below its red signal line, it is probable that selling interest will remain intact for the time being. Nevertheless, the rising slope in the SMAs implies that the ongoing bearish wave might be a component of the larger bullish trend.

In the event the price returns above the broken support trendline at 1.3155, the bulls will stage another battle around the 1.3265 peak and the tough resistance line from April. The 1.3300 number will be closely watched as well, and if buyers claim that barrier, the rally could pick up steam towards the 1.3400 round level. Above that, there are no significant obstacles until the 1.3600 level.

In summary, GBPUSD might experience ongoing downward pressure in the next few sessions, especially if it closes below 1.3100. For a bullish continuation, the price must exceed the resistance trendline at 1.3265.