Gold has been on a winning streak, rising for seven straight months and gaining 21% so far this year. The key question now is whether this momentum will continue in September or if the metal will take a break. The future of gold prices will largely depend on upcoming U.S. economic data and interest rate expectations. The overall market trend for gold remains positive, and many believe the metal is still undervalued, especially with ongoing inflation concerns. Additionally, lower bond yields, driven by expectations of Federal Reserve rate cuts, should continue to support gold’s strength.

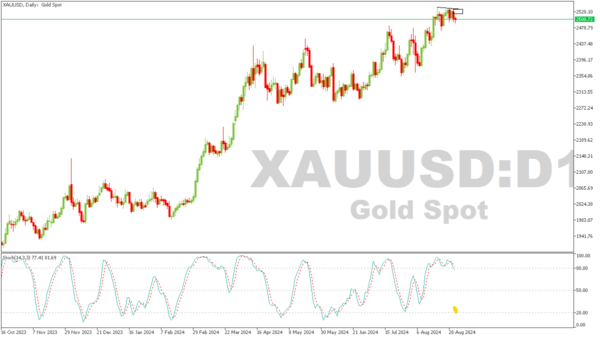

XAUUSD – D1 Timeframe

The Daily timeframe of XAUUSD gives a bare hint at the likelihood of a bearish rally based on the stochastic indicator being overbought; and creating a divergent pattern. This initial indication however needs closer observation before any form of conclusion can be made regarding the outcome.

XAUUSD – H1 Timeframe

The 1-hour timeframe presents a more reliable insight into the price action. Here on the chart, we see the supply zone created as a result of the break below the trendline support. Next, price bounced off the daily timeframe pivot zone, heading for the supply area. Now, if the rejection from the supply zone crosses below the secondary trendline support, we would have a confirmation for the bearish sentiment.

Analyst’s Expectations:

- Direction: Bearish

- Target: $2,489.79

- Invalidation: $2,529.10