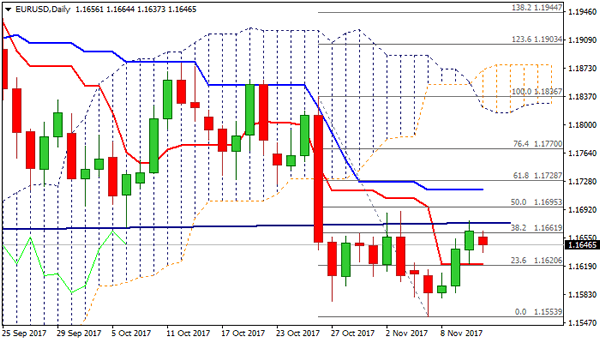

The Euro eases on Monday after three-day rally last week which peaked at 1.1677 and was capped by broken neckline of daily H&S pattern.

Pullback so far looks as corrective action as underlying near-term bias remains bullish.

Dip-buying is seen as favored scenario with broken daily Tenkan-sen (1.1622) expected to contain extended dips. Rising hourly cloud (spanned between 1.1633 and 1.1617) also underpins near-term action.

Friday’s close above 1.1661 (Fibo 38.2% of 1.1836/1.1553 downleg) and bullish weekly close were positive signals for extended recovery.

Fresh upside action requires sustained break above falling 20SMA (1.1684) to generate bullish signal for 1.1700+ recovery.

Conversely, break and close below Tenkan-sen (1.1622) will bearish signal and would shift near-term focus towards key support at 1.1653 (07 Nov low).

Res: 1.1664, 1.1677, 1.1684, 1.1716

Sup: 1.1637, 1.1622, 1.1585, 1.1553