Oil price fell further in early Monday, in extension of Friday’s 3% drop (the biggest daily loss since Aug 14).

The sentiment weakened further on renewed concerns about demand from the US and China, partial reopening of Libya’s oil installation and decision from OPEC to increase production by 180,000 barrels per day in October, partially reversing their 2.2 million bpd.

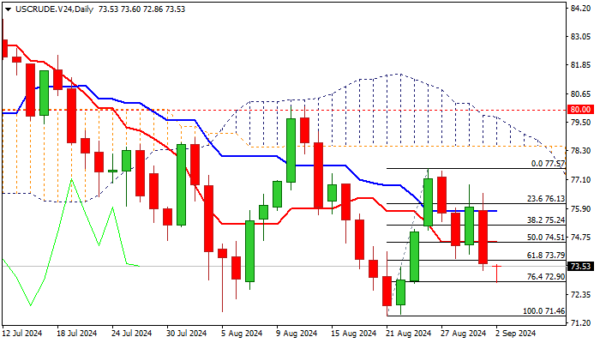

Weak technical studies on daily chart (strong negative momentum / MA’s back to full bearish configuration) add to bearish near-term outlook.

Fresh weakness cracked pivotal Fibo support at $72.90 (76.4% of $71.46/$77.57 upleg), with firm break here to open way for retest of key support at $71.46 (Aug 21 low, the lowest since Feb 5).

Last week’s bearish candlestick with long upper shadow points to strong offers and adds to downside pressure, though Aug tight monthly Doji candle partially offsets negative signals.

Broken Fibo 61.8% support ($73.79) marks initial resistance, with extended upticks to be capped under daily Tenkan-sen / broken 50% retracement ($74.51) to keep larger bears in play.

Res: 73.79; 74.51; 75.24; 75.80.

Sup: 72.90; 72.19; 71.66; 71.46.