- USDJPY continues to hover around the 146 area

- Market participants are preparing for the US CPI release

- Momentum indicators remain mixed

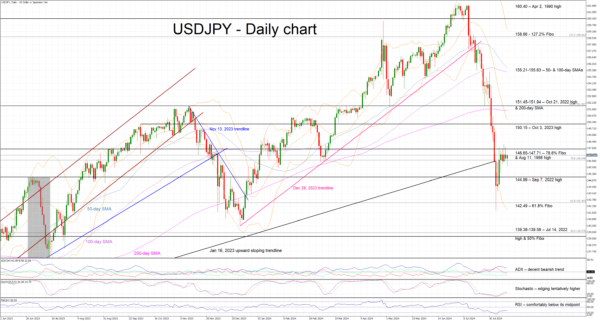

USDJPY continues to trade sideways, hovering around the 146.65-147.71 area for the fifth consecutive session. The bears are holding most of the gains of the sizeable correction from the early July high of 161.94, but have failed to take advantage of USD’s recent underperformance.

With traders digesting the overnight news of the Japanese PM Kichida’s resignation, the focus is gradually turning to today’s US CPI report. This data could play a key role in provoking a dovish shift from the Fed at the imminent Jackson Hole Symposium and thus confirm expectations for a rate cut in September.

In the meantime, the momentum indicators are mixed. Specifically, despite the recent small upleg in USDJPY, the RSI remains below its midpoint and thus reveals a decent bearish pressure in USDJPY. Interestingly, the Average Directional Movement Index (ADX) continues to hover above its 25 threshold, pointing to a muted bearish trend in USDJPY. More importantly, the stochastic oscillator has managed to climb above its overbought area (OB), but it has probably run out of fuel as it is now trading sideways.

Should the bears remain confident, they could firstly try to push USDJPY below the 146.65-147.17 area, which is populated but the 78.6% Fibonacci retracement of the October 21, 2022 – January 16, 2023 downtrend and the August 11, 1998 high. They could then stage another sell-off towards the 144.99 level and gradually prepare for a retest of the 61.8% Fibonacci retracement at 142.49.

On the flip side, the bulls are desperately looking for another small upleg above the 146.65-147.71 area. They could lead USDJPY higher towards the October 3, 2023 high at 150.15, with the next plausible target being the busy 151.45-151.94 area.

To sum up, the relative calmness in USDJPY might not last as the market is preparing for some key US data releases.