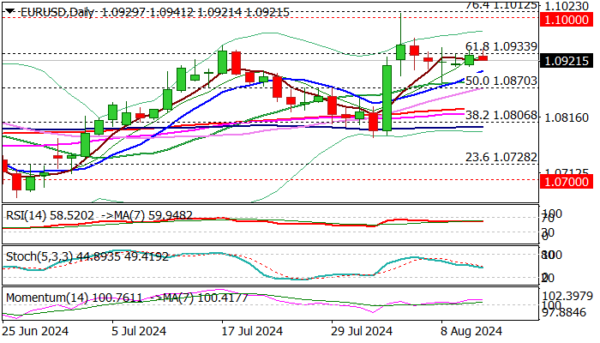

EURUSD is holding within a narrow congestion, capped by Fibo resistance at 1.0933 (Fibo 61.8% of 1.1139/1.0601), as markets slowed ahead of key release this week – US inflation report.

German ZEW economic sentiment (July f/c 32.6 vs June 41.8) due in a while, would also impact Euro’s sentiment.

Technical picture is predominantly bullish on daily chart (strong positive momentum / 10-20DMA bull-cross), but firm break of 1.0933 pivot is required to revive larger bulls after consolidation and expose key barriers at 1.1000 zone (psychological / Fibo 76.4%) where the action faced strong upside rejection last week.

Near-term bias is expected to remain bullish above rising 10DMA (1.0901), guarding lower pivots at 1.0882/70 (20DMA / broken 50% retracement) loss of which would weaken near term structure and risk further drop.

Res: 1.0933; 1.0945; 1.0962; 1.1000.

Sup: 1.0901; 1.0882; 1.0870; 1.0832.