- GBP/USD is declining due to speculation of a BoE rate cut and concerns about global growth.

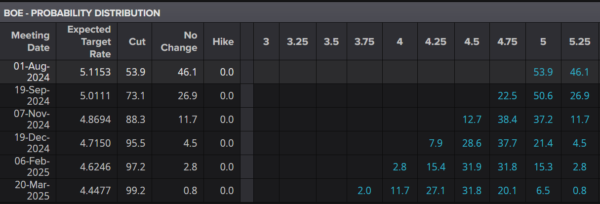

- Market participants are pricing in a 53% chance of rate cuts in August, but economists polled predict an 80% chance of a cut.

- Technically, GBP/USD has support at 1.2850 and resistance at 1.2950.

Cable has continued to edge toward support at the 1.2850 handle as high impact US data lies in wait. Market participants meanwhile have upped the probability of a rate cut by the Bank of England at next week’s meeting to 53%, and pricing in around 52bps of cuts in 2024. A Reuters poll conducted from July 18-24 revealed that over 80% of economists expect the Bank of England (BoE) to lower its key borrowing rates by 25 basis points (bps) to 5% in the August meeting. However, June’s poll indicated a higher expectation, with 97% of respondents anticipating a rate cut. In contrast, market participants are currently pricing in only a 53% chance of rate cuts in August.

BoE Rate Cut Probabilities

Source: LSEG

It appears that the pivot which drove US stocks lower toward the back end of last week may be affecting markets as a whole. We are seeing shifting sentiments and positioning by market participants as rate cut bets ramp up while concerns around global growth in H2 2024 continue to grow as well.

The UK business optimism index which is published by the Confederation of British Industry in its Industrial Trends Survey, is an average of 400 small, medium, and large manufacturing companies are surveyed each quarter. The index dropped significantly in Q3 to -9 compared to the print in Q2 which was a positive 9.

This is surprising given the optimism around rate cuts, but it could also be attributed to growing concerns about slower global growth in Q3 and Q4, alongside expectations of a rise in UK inflation during the same period.

US Data Ahead

US GDP data expected later today may trigger some volatility in GBP/USD, with an anticipated print of 2%. However, I predict a 2.3-2.5% print, which should reassure Federal Reserve officials about the economy’s health. The impact on the US dollar could be two-fold, depending on market perception. A positive GDP reading could confirm economic strength and support expectations for rate cuts starting in September, potentially weakening the USD.

Conversely, a lower-than-expected GDP could heighten recession fears and reduce rate cut expectations, leading to short-term US dollar appreciation. Given recent market sensitivity to data, how this information is perceived will likely be crucial.

Technical Analysis

From a technical standpoint, GBP/USD has been steadily declining since peaking just above the psychological 1.3000 level.

Immediate support is at 1.2850, and a break below this may lead to a third test of the ascending trendline. On the Daily timeframe, price action and structure remain bullish, but a daily candle close below 1.26200 is needed to shift the overall trend.

For this to materialize, however, the pair must first navigate the 100 and 200-day moving averages, which are positioned at 1.2680 and 1.2622, respectively.

Alternatively, an upward move will encounter resistance at 1.2950 before the psychological 1.3000 level becomes significant again.

GBP/USD Chart, July 25, 2024

Source: TradingView (click to enlarge)

Support

- 1.2850

- 1.2680

- 1.2620

Resistance

- 1.2950

- 1.3000

- 1.3040