- EURGBP drops to the lowest level since August 2022

- Political unrest and weaker economic data keep the euro under pressure

- Momentum indicators could point to a reversal soon

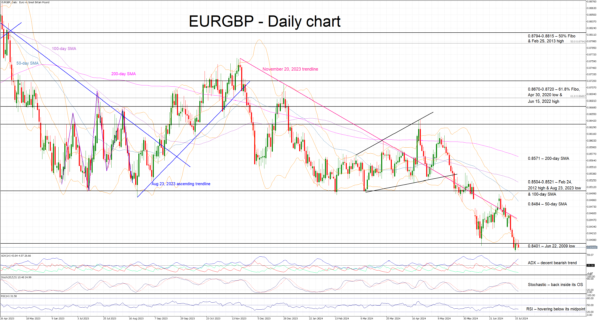

EURGBP is hovering around the lowest level since August 2022, having recorded a decent correction from the early July local peak. The newfound political stability in the UK is supporting the pound while the euro remains under pressure on the back of the political unrest in France and a series of weaker economic data prints. The market is preparing for Thursday’s ECB meeting, where a dovish show by President Lagarde could open the door to another downleg.

In the meantime, the momentum indicators are mostly mixed. The Average Directional Movement Index (ADX) remains above its 25-threshold, and it is edging higher in a vertical fashion. The RSI is stuck below its 50-midpoint, but it appears to be unable to test its mid-June lows. Similarly, the stochastic oscillator has returned inside its oversold area (OS), but it has failed to record a lower low as seen in the EURGBP. This could mean that a bullish divergence could be in the works.

Should the bulls manage to retake control, they could first try to push EURGBP above the 0.8401 level and then stage a rally towards the 50-day simple moving average (SMA) at 0.8484. If successful, they could then test their determination against the busy 0.8504-0.8521 area, which is defined by the February 24, 2012 high, the August 23, 2023 low and the 100-day SMA.

On the flip side, the bears appear determined to maintain their recent gains by keeping EURGBP below the 0.8401 level. They could then gradually push it lower towards the August 4, 2022 low at 0.8339, with the December 5, 2016 low being a tad lower at 0.8304.

To sum up, EURGBP remains on the back foot and a dovish show at Thursday’s ECB meeting could potentially open the door to a more protracted correction towards the 0.8300 area.