- NZDUSD is in a steady decline since early June

- Completion of golden cross fails to trigger a recovery

- Oscillators are tilted to the bearish side

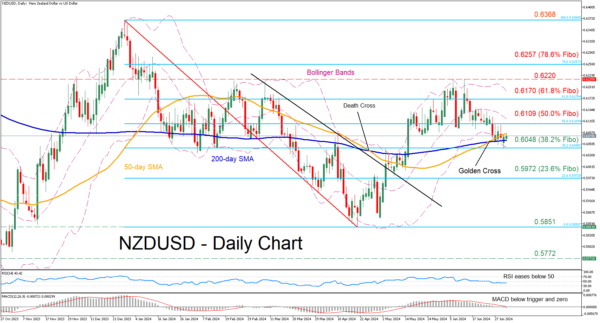

NZDUSD had been in an aggressive uptrend following its 2024 bottom of 0.5851 in mid-April, surging to a six-month high of 0.6220 in June. However, the pair has come under severe selling pressure since then, with the 200-day simple moving average (SMA) preventing further declines for now.

Should the bears attempt to push the price lower, immediate support could be found at 0.6048, which is the 38.2% Fibonacci retracement of the 0.6368-0.5851 downleg. Lower, the 23.6% Fibo of 0.5972 could provide downside protection. A violation of that zone could open the door for the 2024 low of 0.5851.

Alternatively, if the pair stages a recovery, the 50.0% Fibo of 0.6109 could prove to be the first barricade for the bulls to overcome. Further advances could then cease at the 61.8% Fibo of 0.6170 ahead of the six-month peak of 0.6220. Even higher, the 78.6% Fibo of 0.6257 could curb the pair’s upside.

In brief, NZDUSD has been undergoing a pullback in the short term, while the completion of a golden cross between the 50- and 200-day SMAs has failed to reverse this slide. Nevertheless, things could get even worse in the case that the price breaks decisively below its 200-day SMA.