The dollar index regained traction on Tuesday and ticked higher after dropping 0.4% on Monday.

Pullback was contained by daily cloud top and marked a light correction of a larger uptrend, which remains intact.

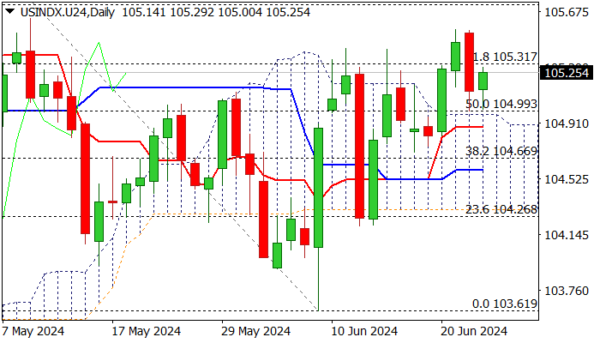

Technical picture on daily chart remains bullish, as MA’s are in bullish setup, positive momentum is strong and price action underpinned by daily cloud.

Markets await release of US inflation data (PCE) on Friday, to get more clues about Fed’s rate path, which is expected to strongly influence dollar’s performance.

Focus will be also on the first debate of US presidential candidates, French election, as well as on geopolitics, especially after the latest signals that the conflict may spread on Lebanon.

Bullish near term bias is expected above 105.00 support (cloud top / 10DMA) for renewed attempt towards 105.71 (Fibo 76.4% of 106.36/103.61), while loss of 105 handle would weaken the structure and risk deeper drop towards 104.47/28 (100 / 200DMA’s respectively.

Res: 105.54; 105.71; 106.00; 106.36.

Sup: 105.00; 104.78; 104.47; 104.28.