In this technical article we’re going to take a quick look at the Elliott Wave charts of Bitcoin BTCUSD , published in members area of the website. As our members know, Bitcoin is doing a correction against the 56510 low, which is unfolding as a Flat pattern. Now, the crypto is showing impulsive sequences in the cycle from the June 7th peak, which can be the last leg of the proposed Flat pattern. Consequently, we expect more short-term weakness in the near term. In the further text, we are going to explain the wave count.

BTCUSD H1 Weekend Update 06.23.2024

BTCUSD has broken the previous low, confirming more downside in the near term against the 66484 pivot. The current view suggests that the intraday recovery completed at the 64482 high as b red. While below that high, we believe the c red leg is in progress toward new lows, targeting the 61592-59793 area. We expect Bitcoin to keep finding intraday sellers in 3, 7, and 11 swings.

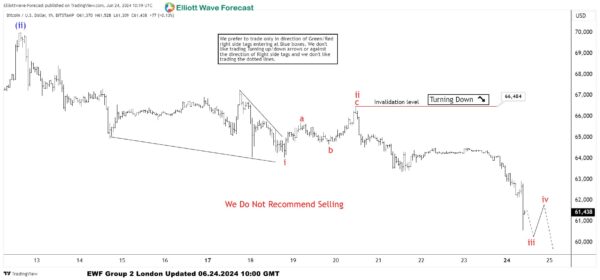

BTCUSD H1 London Update 06.24.2024

Bitcoin made a further decline as expected, reaching our first target zone at 61592-59793. From there, we can see an intraday bounce. The count has been adjusted, now suggesting we are potentially still within wave (iii), which is part of the last leg of the proposed Flat pullback. We don’t recommend forcing trades in BTCUSD at this stage.