Gold price edged higher in early Wednesday’s trading after softer than expected US retail sales numbers improved the sentiment on fresh expectations for Fed rate cut this year.

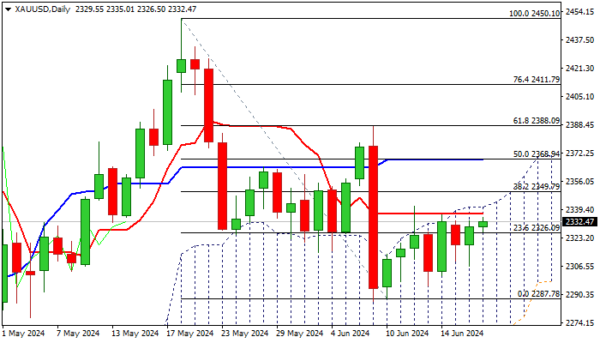

The price is holding near pivotal barrier at $2341 (recent range ceiling /top of ascending daily Ichimoku cloud), which caps for the eighth consecutive day.

Technical studies on daily chart remain bearishly aligned (14-d momentum in negative territory /daily Tenkan/Kijun-sen in bearish setup) and the downside is expected to remain vulnerable as long as price action stays below cloud top.

In such scenario, we can expect prolonged sideways near-term mode, with renewed attack at range floor ($2287) not ruled out, if fundamentals weaken.

Loss of $2287 pivot would spark stronger acceleration lower, as this will complete a failure swing pattern, as well as asymmetric Head and Shoulders pattern ($2287 also marks the neckline).

Conversely, sustained break above cloud top would generate bullish signal which will require confirmation on break of $2349 (Fibo 38.2% of $2450/$2287) to open way towards targets at $2368 and $2388 (Fibo 50% and 61.8% respectively).

Res: 2337; 2341; 2349; 2368.

Sup: 2326; 2300; 2287; 2272.