- GBPJPY unlocks a new high after the Bank of Japan defies expectations of reduced bond purchases

- Technical signs are positive, but the bulls need to breach the 201 obstacle

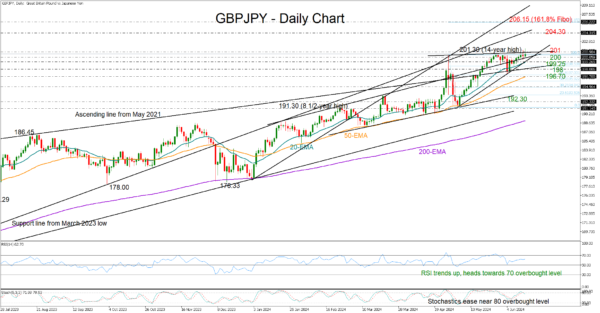

GBPJPY stepped on the long-term ascending line at 200 and jumped to a new 14-year high of 201.59 in the BoJ aftermath on Friday with scope to continue its long-term positive trend.

The short-term risk is more on the upside than on the downside. Specifically, the exponential moving averages (EMAs) are sloping upwards, promoting the bullish trajectory in the market. In technical indicators, the RSI keeps strengthening above its 50 neutral mark and towards its 70 level, although the stochastic oscillator is already hovering near its 80 overbought level.

Buyers would like to see a clear close above the 201 number in order to stage an exciting rally towards the constraining line from March 2023 at 204.30. Even higher, the pair could target the 161.8% Fibonacci extension of May’s downfall at 206.15.

Alternatively, a pullback could retest the 200 level and perhaps seek support near the 20-day EMA at 190.25 before heading for the key 198.00 area. If a slide occurs below the latter, it could indicate a bearish reversal and potentially lead to a sharp correction towards the 50-day EMA at 196.70.

In summary, GBPJPY remains bullish in the short-term, and traders are looking for a close above 201 to drive additional buying.