Key Highlights

- USD/JPY is eyeing an upside break above the 156.40 resistance.

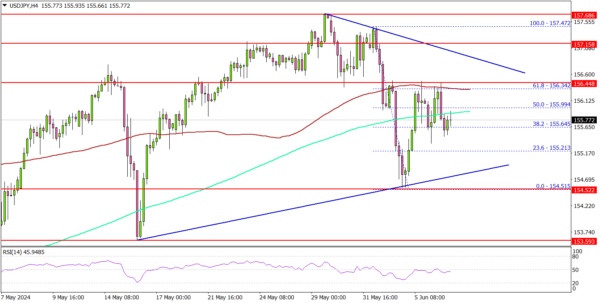

- A major bearish trend line is forming with resistance at 156.60 on the 4-hour chart.

- EUR/USD is gaining pace above the 1.0880 resistance.

- Gold prices recovered above the $2,350 resistance zone.

USD/JPY Technical Analysis

The US Dollar remained well- supported above the 154.50 level against the Japanese Yen. USD/JPY formed a base and started a fresh increase above 155.00.

Looking at the 4-hour chart, the pair was able to clear the 155.80 and 156.00 resistance levels. However, the bears are currently active near the 100 simple moving average (red, 4-hour). The pair is now consolidating near the 200 simple moving average (green, 4-hour).

Immediate support is near the 155.20 level. The next major support is near the 155.00 zone. A downside break and close below the 155.00 support zone could open the doors for a larger decline. In the stated case, the pair could decline toward the 154.20 level.

On the upside, immediate resistance is near the 155.20 zone. The first major resistance is near the 155.40 level. There is also a major bearish trend line forming with resistance at 156.60 on the same chart.

A clear move above the 155.60 resistance might send it toward the 157.20 level. Any more gains might call for a move toward the 158.00 level in the near term.

Looking at EUR/USD, the pair is showing bullish signs, and the bulls might soon aim for a move toward the 1.0950 level in the near term.

Economic Releases

- US nonfarm payrolls for May 2024 – Forecast 185K, versus 175K previous.

- US Unemployment Rate for May 2024 – Forecast 3.9%, versus 3.9% previous.