- GBPUSD advances to its highest level since March 13

- But the advance starts to look overstretched

- Momentum indicators approach overbought conditions

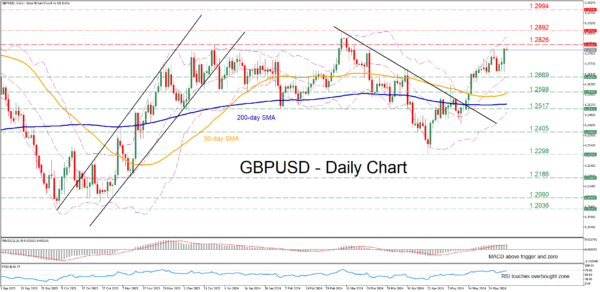

GBPUSD has been in a steady recovery following its bounce off the 2024 bottom of 1.2298, with the price violating both the 50- and 200-day simple moving averages (SMAs). On Tuesday, the pair posted a fresh two-month peak, but quickly sustained some losses as the rally is starting to look overdone.

If the price extends its upward trajectory, the bulls could initially attack the December 2023 high of 1.2826. A violation of that region could set the stage for the 2024 peak of 1.2892. Failing to halt there, the pair could storm towards the July 2023 resistance of 1.2994.

On the flipside, should the pair reverse lower, the recent support of 1.2669 could act as the first line of defence. Further retreats could cease around 1.2598, a region that held strong both in January and March. Failing to halt there, the price could descend towards the February bottom of 1.2517.

Overall, even though GBPUSD surged to a fresh two-month high on Tuesday, its rally appears to be running out of juice. Nevertheless, a break below the 50-day SMA is needed for the short-term outlook to turn bearish.