Hey guys! Here comes June, and here, as usual, I share a few interesting trade ideas, and opportunities to capitalize on for profits. Here in this short piece, I present 3 pairs that are currently on my radar for the month of June. Be sure to do your due diligence, and avoid trading into moments of increased volatility if you’re incapable of handling such situations. Cheers!

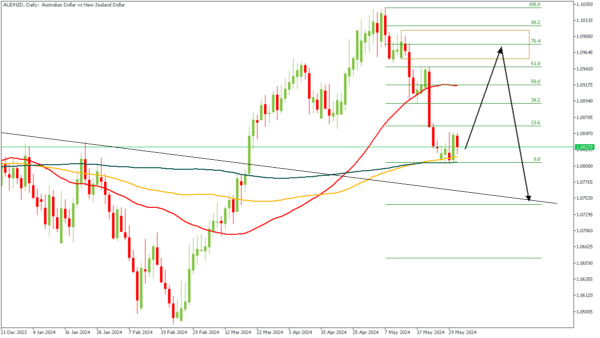

AUDNZD – D1 Timeframe

AUDNZD on the daily timeframe is currently resting on a confluence of the 100 and 200-day moving averages. This means we can expect some bullish pressure in the market soon, after which, based on the recent break below the previous low, I anticipate a resumption of the bearish trend. The Fibonacci retracement level, rally-base-drop supply zone, and the break of structure are my confluence for this sentiment.

Analyst’s Expectations:

- Direction: Bearish

- Target: 1.08584

- Invalidation: 1.10336

CADCHF – D1 Timeframe

CADCHF on the daily timeframe seems bullish, as indicated by the bullish array of the moving averages. Following this, we can see the trendline support, and how it aligns perfectly with the drop-base-rally demand zone from the wick of the highlighted candlestick. All of these factors add up to convince me in favor of a bullish sentiment.

Analyst’s Expectations:

- Direction: Bullish

- Target: 0.66679

- Invalidation: 0.65275

EURCAD – D1 Timeframe

I know this EURCAD chart may look somewhat like a construction drawing, but trust me, it is a valid analysis. Firstly, we have price getting rejected off the trendline resistance of an equidistant channel, following a break of structure above the previous high. Secondly, we see the previous trendline resistance that price broke, which I expect to now act as an area of support. And lastly, we see the drop-base-rally demand zone, moving average supports, as well as the Fibonacci retracement levels converging around the same area – these serve as a confluence for the bullish sentiment.

Analyst’s Expectations:

- Direction: Bullish

- Target: 1.48120

- Invalidation: 1.45930

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.