- EURGBP remains directionless near the long-term 0.8500 reflection point

- Technical signals flag oversold conditions, but a bullish outlook could come above 0.8600

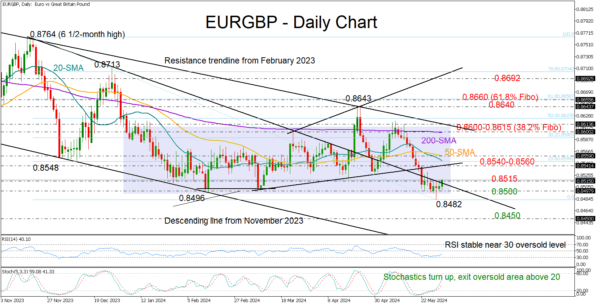

Despite hitting a 20-month low of 0.8482, EURGBP has remained flat and unable to establish a clear direction around the significant level of 0.8500 over the past week.

Eurozone’s preliminary CPI inflation data will be out today at 09:00 GMT. From a technical perspective, the bulls might be around the corner given the positive reversal in the stochastic oscillator. The RSI, although not showing any strong bias, is hovering near the oversold level of 30, promoting the bullish scenario too.

Still, a bullish correction may not entice buyers unless the price crosses above the range of 0.8540-0.8560. A decisive close higher could produce another leg up to 0.8600-0.8615 region, where the key falling descending trendline from February 2023 is placed. The pair will have to breach that territory as well to resume its positive medium-term outlook.

If the 0.8500 floor cracks, the pair may face considerable pressure to find shelter around the 0.8450 barrier, which was last observed in 2021-2022, or drop towards the psychological mark of 0.8400. Interestingly, the latter overlaps with the descending line, which joins the lows from November 2023 and February 2024.

All in all, EURGBP keeps fighting for a bullish rotation near the familiar 0.8500 base. Even if there is a potential for an upward bounce, downside risks might remain intact unless the price surges above 0.8600-0.8615.