- USDJPY bulls face limitations ahead of the US CPI inflation figures

- Short-term risk tilted to the upside, but confirmation required above 156.60

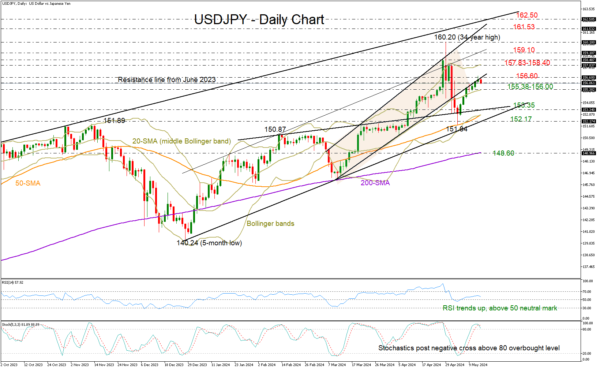

USDJPY recouped more than half of its sharp losses that occurred at the start of the month thanks to the bounce off the 50-day simple moving average (SMA) near 151.84.

But the bulls seem to be struggling to jump back into the broken bullish channel, which is currently capping upside movements near 156.60. Given the pair’s rise above the 20-day SMA and positive RSI trajectory, there is potential for further improvement. Nevertheless, traders could approach the situation cautiously as the stochastic oscillator has charted a negative cross above the overbought level of 80.

Once the pair surpasses 156.60 and the crucial 157.00 round level, attention will quickly turn to the significant resistance zone between 157.83 and 158.70. A victory there is expected to boost the price towards the constraining ascending line at 159.10 and then up to the 34-year high of 160.20. Should the latter option be easily breached, the rally could gain momentum towards the upper band of the channel at 161.53 or slightly higher to 162.50, where the crucial resistance line from June 2023 is situated.

Alternatively, the pair could slip below 156.00 to seek support near the 20-day SMA at 155.38. Should sellers prevail there, the downfall might reach the resistance-turned-support trendline at 153.35 and the 50-day SMA, while the ascending trendline from December’s lows could resume its protective role slightly lower at 152.17. Another failure there might trigger a sharp decline towards the 200-day SMA at 148.96.

In summary, there is potential for USDJPY to continue its upward movement, but traders may want confirmation of a close above 156.35 before placing additional buying orders.

Keep in mind that the US CPI inflation figures for April will be announced today at 13:30 GMT, and analysts predict a bit of a slowdown.