Hello traders. In this blog post, we will look at how GBPCAD advances bullish sequence from late 2023 after it bounced from an equal leg area. As you know, we analyze and trade 78 instruments with members at ElliottWave-Forecast. These 78 instruments are grouped into three categories. This currency pair is in group 2 along with 25 other instruments spread across four asset classes, including Cryptocurrencies, Forex, Indices, and Commodities.

How GBPCAD advances bullish sequence – 05.09.2024 Update

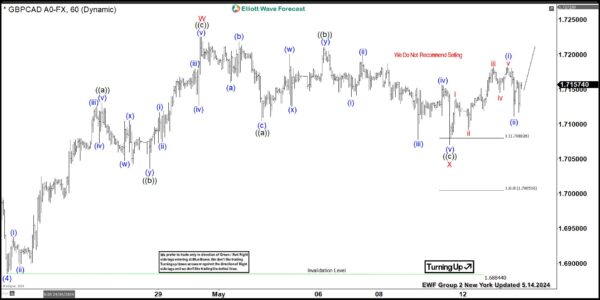

GBPCAD, as our members know, has been in a bullish diagonal sequence since October 2023. This diagonal was expected to complete the primary degree wave ((1)). Wave (4) of ((1)) was completed on 22nd April 2024 at 1.6888. Following wave (4), wave (5) of ((1)) quickly rallied and completed its first leg, wave W. Afterwards, wave X emerged from the 30th April high to form a double zigzag structure. We shared the chart above with members on 9th May 2024, identifying the 1.7080-to-1.7000 equal legs area is crucial for wave X completion.

How GBPCAD advances bullish sequence – 05.14.2024 Update

Just as expected, wave X of (5) found support at the equal leg of 1.7080 and bounced quickly. The chart above was part of the 14th May New York update we shared with members. The chart shows the price separating from the equal leg with an impulse for (i). Going forward, we expect the price to breach the top of wave (i) thus paving the way for wave (iii) of ((a)) of Y. This would give the pair a chance to break wave W high and get wave Y properly underway.

However, we always take note of the alternatives. If the current dip for (ii) extends lower below X, then we will have to determine a new extreme for wave X where buyers will look for new LONG positions in anticipation of Y. Ideally, we would like to see the wave W high breached and then look for LONG positions after the next pullback completes 3, 7, or 11 swings in the extreme area.