- US 100 stock index eyes March all-time high

- But latest upleg may have run its course

- Is a correction on the way or is a record peak in sight?

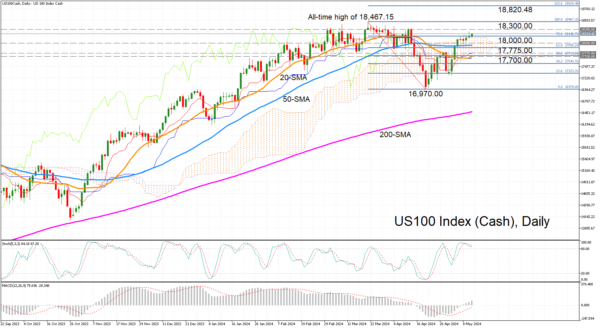

The US 100 stock index (cash) has recovered by more than 7% from the April dip when it hit a three-month low of 16,970.00. But despite climbing on top of the Ichimoku cloud and surpassing the 18,000.00 level, the bullish prospects for the near term have started to fade.

The stochastics are negatively aligned and edging lower within the overbought territory, while the 20-day simple moving average (SMA) has only just started to turn upwards. However, the MACD continues to send positive signals as it’s still rising above zero and above its red signal line.

If the bulls stay in charge, there could be some resistance near 18,300.00, as this has been a congested area in the past. Overcoming it would boost the index’s chances of challenging its record high of 18,467.15 and open the way for the 123.6% Fibonacci extension of the March-April downtrend at 18,820.48.

However, if the price slips back inside the Ichimoku cloud, the 18,000.00 mark is likely to be tested again – a support region that is signified by the 50-day SMA lurking slightly below it. Lower down, there are further strong support zones consisting of the cloud bottom and Tenkan-sen line around 17,775.00, and the 20-day SMA and 50% Fibonacci retracement around 17,700.00.

Should these barriers fail, the US 100 would be at risk of revisiting the April trough and entering a new bearish phase. But to sum up, as long as the price holds above the cloud, the short-term prospects should remain bullish, as should the longer-term outlook.