- The Hang Seng Index has transformed into a medium-term uptrend phase with key support at 17,110.

- Momentum factor is now taking a front seat over fundamentals such as the deflationary risk spiral.

- A softer than-expected China CPI and PPI prints for April may further erode consumer confidence.

- A yuan devaluation cannot be ruled out to offset weak domestic demand via a boost in export growth that can spark a currency war.

In an abrupt turn of events, after being the worst-performing stock market in the world since 2022, the major benchmark China and its proxy Hong Kong stock indices reversed up in April and even outperformed the highflying technology and artificial intelligence (AI) heavily weighted US Nasdaq 100.

A more pronounced outperformance can be seen in the Hong Kong benchmark stock indices where the Hang Seng China Enterprises Index gained by +8% in April followed by Hang Seng Index (+7.4%) and Hang Seng TECH Index (+6.42%) while the China CSI 300 recorded a smaller gain of +1.9%.

In contrast, the Nasdaq 100 and the MSCI All-Country World Index exchange-traded fund were battered with monthly losses of -4.5% and -3.5% in April.

Momentum factor and under-positioning are likely the key catalysts

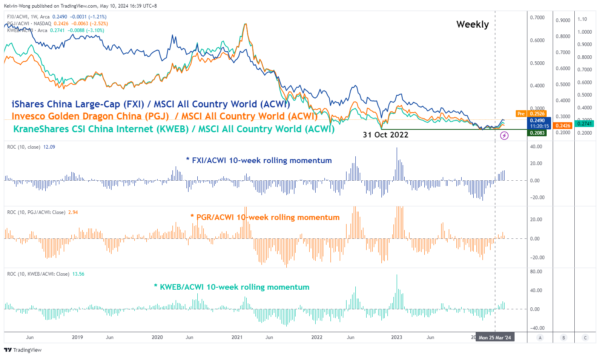

Fig 1: Key China thematic equities ETF / MSCI All Country World Index ETF ratios as of 9 May 2024 (Source: TradingView, click to enlarge chart)

The ratios of key China-related equities exchange-traded funds (ETF) listed in the US; iShares China Large-Cap (FXI), Invesco Golden Dragon China (PGR), and KraneShares CSI China Internet (KWEB) over the MSCI All-Country World Index ETF (ACWI) have seen their major underperformance stalled in late January 2024 as these ratios managed to find support at their respective late October 2022 swing lows.

Thereafter, the 10-week rolling momentum factor of these ratios has turned positive concurrently in the week of 25 March 2024 which in turn triggered the positive momentum feedback loop (see Fig 1).

Also, according to the Bank of America Merrill Lynch fund manager’s survey conducted in early April, respondents have highlighted China was the most underweighted geographical region in their portfolios (net 13%). Thus, a picked-up in positive momentum can easily spark a FOMO (fear of missing out) induced behaviour due to its grossly underweighted positioning that led to further rallies.

Can the rally in the Hang Seng Index continue?

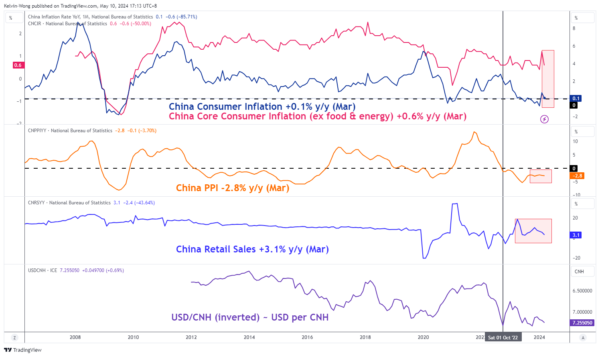

Fig 3: China consumer & producer inflationary trends with USD/CNH as of 10 May 2024 (Source: TradingView, click to enlarge chart)

For this week, the Hang Seng Index has continued to add to its gains as it ended today, 10 May with a weekly gain of +4.7%, its third consecutive week of positive return and a month-to-date gain of +6.8% for May that outperformed the Nasdaq 100 (+3.9%), and MSCI All-Country World Index ETF (3.6%) as of 9 May.

In the lens of technical analysis, the monthly RSI momentum indicator has staged a bullish momentum breakout below the 50 level. Also. it has yet to reach its overbought region of 70 and above which suggests that there is still potential medium-term (multi-week to multi-month) bullish impulsive upmove sequence as the price actions of the Hang Seng Index transformed into a medium-term uptrend phase via the bullish breakout of its former major descending trendline resistance from February 2021 (see Fig 2).

Watch the 17,110 key medium-term pivotal support on the Hang Seng Index with the next medium-term resistances coming in at 20,400 and 22,520.

The key risk that may derail the bullish tone seen in the Hang Seng Index is the revival of the deflationary risk spiral in China. Tomorrow, 11 May, we will have the latest set of China consumer (CPI) and producer inflation (PPI) data for April. In March, both the CPI and PPI inched lower to 0.1% y/y and -2.8% y/y respectively which also saw a decelerated growth in retail sales in the same month (3.1% y/y versus 5.5% y/y in February).

If China’s consumer and producer inflation trends continue to plummet lower in April, it suggests that the deflationary risk spiral is still intact which in turn can lead to a further erosion of consumer confidence followed by a potential deceleration in domestic demand (see Fig 3).

To make up for a tepid domestic demand environment, China’s policymakers may opt for a devaluation of the yuan to boost export growth that in turn likely to trigger a currency war among nations that are dependent on exports; such beggar-thy-neighbour monetary policies are not conducive for a risk-on environment.