Key Highlights

- USD/JPY started a recovery wave above the 154.00 resistance.

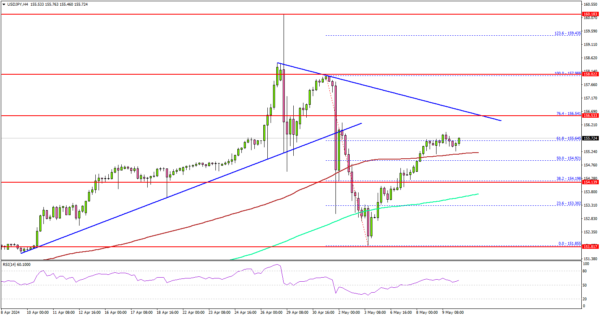

- A major bearish trend line is forming with resistance at 156.50 on the 4-hour chart.

- EUR/USD could aim for a steady increase if it clears 1.0820.

- Oil prices are facing many hurdles near $80.80 and $81.80.

USD/JPY Technical Analysis

The US Dollar found support at 151.85 and started a steady upward move against the Japanese Yen. USD/JPY cleared the 153.20 and 154.00 resistance levels.

Looking at the 4-hour chart, the pair surpassed the 50% Fib retracement level of the downward move from the 157.98 swing high to the 151.85 low. It also settled above the 100 simple moving average (red, 4-hour) and tested the 200 simple moving average (green, 4-hour).

However, there are a couple of hurdles waiting to prevent upsides. Immediate resistance is near the 156.20 level. The first major resistance is near 156.50.

There is also a major bearish trend line forming with resistance at 156.50 on the same chart. The trend line is close to the 76.4% Fib retracement level of the downward move from the 157.98 swing high to the 151.85 low.

A clear move above the 156.50 resistance might send it toward the 158.00 level. Any more gains might call for a move toward the 160.00 level in the near term.

Immediate support is near the 155.20 level and the 200 simple moving average (green, 4-hour). The next major support is at 154.00. If there is a downside break below the 154.10 support, the pair might test 153.50 and the 100 simple moving average (red, 4-hour). Any more losses might send the pair toward 152.20.

Looking at EUR/USD, the pair is consolidating, and the bulls might soon aim for an upside break above the 1.0820 resistance.

Economic Releases

- UK GDP Q1 2016 (Preliminary) (QoQ) – Forecast +0.4%, versus -0.3% previous.

- Fed’s Kashkari speech.

- Fed’s Logan speech.