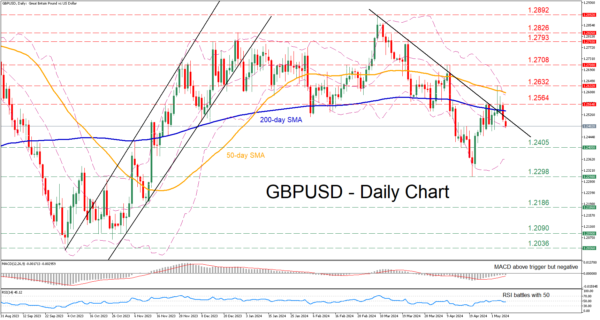

- GBPUSD reverses lower after 50-day SMA curbs advance

- Violates both the 200-day SMA and descending trendline

- Momentum indicators are neutral-to-negative

GBPUSD had been in a recovery mode following its bounce off the five-month bottom of 1.2298, with the price temporarily violating the 200-day simple moving average (SMA). However, the pair retraced back below the downward sloping trendline, in place since March, after failing to conquer the 50-day SMA.

Should bearish pressures persist, the price may retreat towards the April support of 1.2405. Further declines could then cease at the five-month low of 1.2298. Dipping beneath that area, the price may face the November 2023 support of 1.2186.

On the flipside, if buyers re-emerge and push the price back above the descending trendline, the April-May resistance zone of 1.2564 could act as the first line of defence. A break above that territory could pave the way for the recent deflection point of 1.2632. Even higher, the April peak of 1.2708 could curb further upside attempts.

Overall, GBPUSD has been on the retreat in the past couple of sessions due to its inability to reclaim the 50-day SMA. Hence, for the short-term picture to improve, the pair needs to break above the restrictive trendline that connects its lower highs since March.