Cable is holding within a narrow range on Tuesday as traders await fresh signals from the key economic event for sterling this week- BoE monetary policy meeting on Thursday.

Data released today (Apr UK construction PMI well above expectations and house prices inched higher) contributed to positive near-term bias, while the price stays above 200DMA (1.2545).

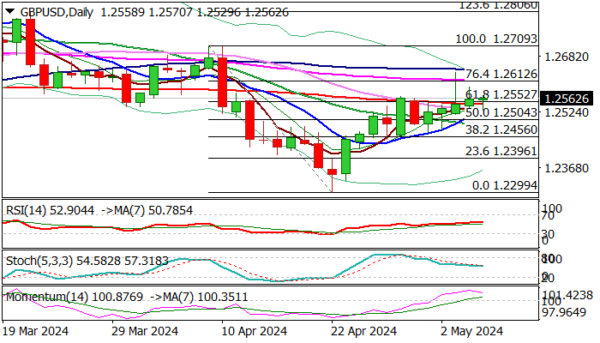

Repeated daily close above 200DMA and broken Fibo barrier at 1.2552 (61.8% of 1.2709/1.2299) to reinforce bullish technical structure and partially offset existing pressure from repeated strong upside rejection in past two days and a bull-trap, left on Friday.

The pair would probably stay in a quiet mode until BoE’s verdict on Thursday, which is likely to generate strong near-term direction signal.

The upside trigger lays at 1.2612 (Fibo 76.4% / 55DMA), with firm break to signal bullish continuation of the upleg from 1.2299 (Apr 22 low).

Conversely, loss of initial supports at 1.2545 (200DMA) and 1.2524 (10DMA) would weaken near term structure and risk extension through lower pivots at 1.2504 (broken Fibo 38.2%) and 1.2486 (20DMA).

Res: 1.2538; 1.2612; 1.2641; 1.2709.

Sup: 1.2545; 1.2504; 1.2486; 1.2405.