Key Highlights

- GBP/USD started a recovery wave above the 1.2500 resistance.

- A connecting bullish trend line is forming with support at 1.2500 on the 4-hour chart.

- Gold prices are attempting a fresh increase above the $2,300 resistance.

- Bitcoin recovered losses and was able to retest the $65,000 resistance zone.

GBP/USD Technical Analysis

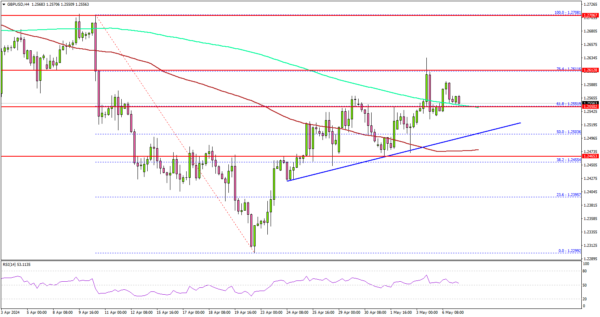

The British Pound found support near 1.2300 against the US Dollar. GBP/USD started a decent increase and was able to clear the 1.2450 resistance.

Looking at the 4-hour chart, the pair climbed above the 50% Fib retracement level of the downward move from the 1.2708 swing high to the 1.2299 low. It also settled above the 100 simple moving average (red, 4-hour) and tested the 200 simple moving average (green, 4-hour).

However, the bears were active near the 1.2620 resistance. They prevented a close above the 76.4% Fib retracement level of the downward move from the 1.2708 swing high to the 1.2299 low.

A clear move above the 1.2620 resistance might send it toward the 1.2700 level. Any more gains might call for a move toward the 1.2800 level in the near term.

Immediate support is near the 1.2550 level and the 200 simple moving average (green, 4-hour). The next major support is at 1.2520. There is also a connecting bullish trend line forming with support at 1.2500 on the same chart.

If there is a downside break below the 1.2520 support, the pair might test 1.2465 and the 100 simple moving average (red, 4-hour). Any more losses might send the pair toward 1.2420.

Looking at Bitcoin, the price gained bullish momentum and was able to test the key resistance at $65,000 and $65,200.

Economic Releases

- UK’s Construction PMI for April 2024 – Forecast 50.4, versus 50.2 previous.

- Euro Zone Retail Sales for April 2024 (MoM) – Forecast +0.6%, versus -0.5% previous.