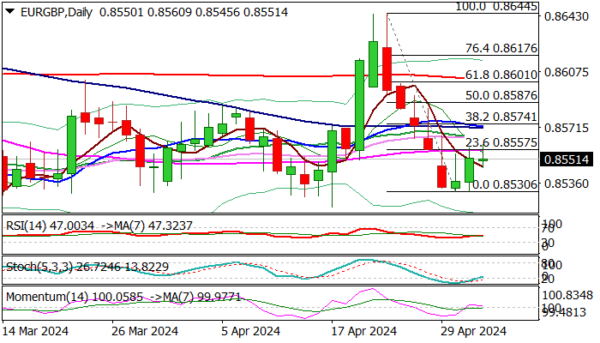

Two-day recovery seems to be running out of steam, following repeated failure to break above thin daily cloud, with long upper shadows on daily candles, warning of persisting pressure.

Technical picture on daily chart is bearishly aligned as MA’s remain in full bearish setup and 14-day momentum turned south and nearing the centreline.

Another failure to clear cloud top, reinforced by 55DMA would add to signals of recovery stall and increase risk of fresh weakness and retest of 0.8530 (Apr 30 low) and 0.8520 (Apr 14 low).

Only acceleration and close above 0.8560 /75 zone, where a cluster of daily MA’s (10/20/100) and Fibo 38.2% of 0.8644/0.8530 bear-leg) would provide relief and shift near-term focus to the upside.

Res: 0.8560; 0.8575; 0.8587; 0.8605.

Sup: 0.8545; 0.8530; 0.8520; 0.8503.