- AUDUSD comes under selling interest this week

- But stays within sideways range

- A break below 0.6485 may turn the outlook bearish

- For the picture to brighten, a move above 0.6615 may be needed

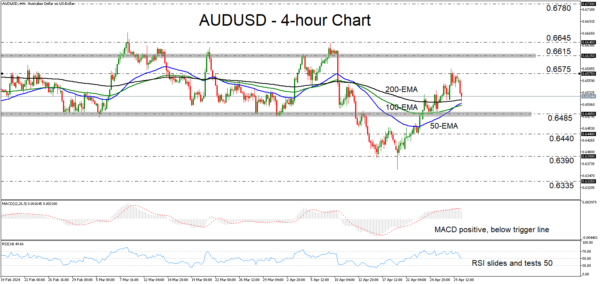

AUDUSD was sold this week, after the bulls struggled to overcome the 0.6575 barrier. In the bigger picture, the pair is trading back within the sideways range that has been containing most of the price action since mid-January and thus, the outlook remains neutral.

The MACD lies well above zero, but it has already crossed below its trigger line and is pointing down, while the RSI has slid and seems ready to challenge its equilibrium barrier of 50. Both indicators detect weakening upside momentum, which means that more bears may jump into the action soon.

That said, for the outlook to turn back bearish, AUDUSD may need to clearly break below 0.6485, the lower boundary of the aforementioned sideways range. Such a dip may initially pave the way towards the 0.6440 zone, marked by the low of April 23, the break of which could carry extensions towards the 0.6390 territory, defined as support by the low of April 16.

On the upside, a break above 0.6615, the upper end of the range, is likely to be needed for the picture to brighten. If the bulls are strong enough to accomplish that, they may find immediate resistance at 0.6645, where another break could open the path towards the 0.6780 zone, which acted as a ceiling between January 4 and 12.

To sum up, AUDUSD came under pressure lately, but it remains within the neutral sideways range between 0.6485 and 0.6615. For the outlook to change, traders may need to take the pair out of that range.