- UK 100 index reaches 8,000 milestone

- But further gains may have to wait as uptrend starts to lose steam

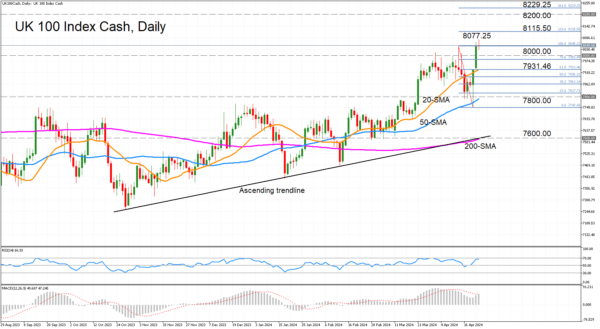

The UK 100 stock index (cash) closed at a new all-time high of 8,046.44 on Monday and climbed to an intra-day record of 8,077.25 earlier today. But whilst another record close is possible in the near term, positive momentum appears to be waning.

The RSI is currently edging sideways slightly below the 70 overbought mark, while the MACD seems to be struggling to cross above its red signal line. Yet, the bullish bias remains fairly strong so how today’s session ends could prove critical to the short-term direction.

If the index manages to regain some upside momentum, the next stop could be 8,115.50, which is the 123.6% Fibonacci extension of the April downleg. Higher up, the 8,200.00 level could attract attention before the 161.8% Fibonacci of 8,229.25 is targeted by the bulls.

To the downside, there could be immediate support at 8,000.00, but the 20-day simple moving average (SMA) is another important support to watch as it is intersecting the 61.8% Fibonacci retracement of 7,931.46. A drop below this point would shift the focus to the busy 7,800.00 region, which is being approached by the 50-day SMA. Breaching this would add to the bearish risks and open the door to the 200-day SMA that has converged with the medium-term ascending trendline in the 7,600.00 area.

In brief, a further rise into uncharted territory is possible in the next few sessions, but there is also a risk that the rally pauses for breath before resuming the uptrend.