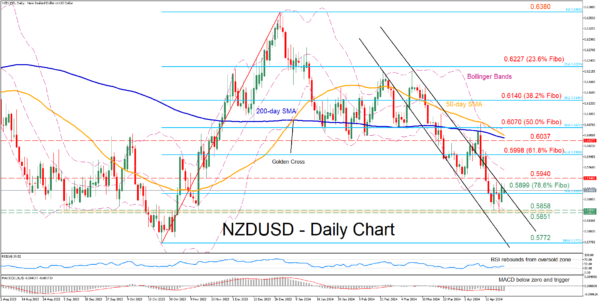

- NZDUSD declines sharply within descending channel

- Drops to its lowest since November before paring some losses

- Oscillators are deep in their negative territories

NZDUSD has been in an aggressive downtrend since its double rejection at the 0.6217 region in early March. Although the pair posted a fresh five-month bottom of 0.5851 last week, it seems that the retreat has paused for now.

Given that both the RSI and MACD remain tilted to the downside, the price might revisit 0.5899, which is the 78.6% Fibonacci retracement of the 0.5772-0.6380 upleg. A violation of that region could pave the way for the 0.5858-0.5851 range, defined by the recent five-month bottom and the September-November support. Failing to halt there, the pair could challenge the 2023 low of 0.5772.

On the flipside, should the pair rotate back higher, immediate resistance could be found at the previous support of 0.5940. Further advances could then cease around the 61.8% Fibo of 0.5998. Conquering this barricade, the bulls may attack the February support zone of 0.6037, which could serve as resistance in the future.

Overall, NZDUSD plummeted to a fresh five-month low but managed to recoup some losses as the decline reached oversold conditions. However, the pair is clearly not out of the woods just yet as near-term risks remain heavily tilted to the downside.