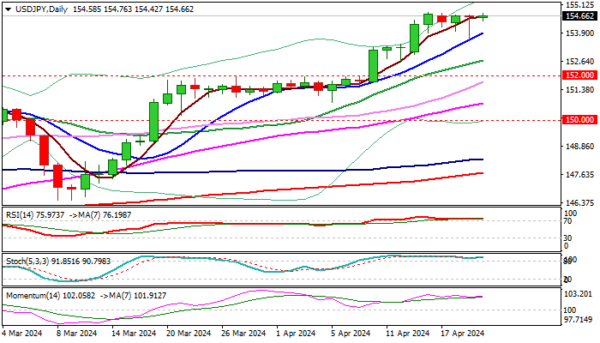

USDJPY keeps firm tone and continues to trade near pivotal 155 barrier, where strong offers cap the action on expectations that Japan’s authorities may intervene at this zone.

Technical picture on daily and weekly chart remains increasingly bullish, with strong positive signal generated on weekly close above important Fibo level at 152.60 (38.2% of larger 277.65/75.55, 1982/2011 downtrend), which would open way for stronger acceleration towards 160 zone (1990 high)., but with major requirement for sustained break of 155.00 trigger.

Rising 10DMA contained last Friday’s spike lower, adding to bullish near-term bias, though overbought conditions and strong headwinds at 155 barrier, warn that price action may stay in extended sideways mode.

Dips should hold above broken 152.60 barrier (reinforced by rising 20DMA) which reverted to strong support, to offer better opportunities to re-join bullish market.

Caution on sustained break below 152.60, which would weaken near-term structure and increase downside risk.

Res: 155.00; 155.77; 156.36; 157.73.

Sup: 154.42; 153.87; 152.60; 152.00.