WTI oil price dips further in early Thursday, in extension of previous day’s 3% drop (the second biggest daily loss in 2024) and hit new three-week low.

Stronger than expected rise in US crude inventories (EIA report) further raised concerns about oil demand, while fears about escalation of the conflict in the Middle East faded, pushing the price sharply lower.

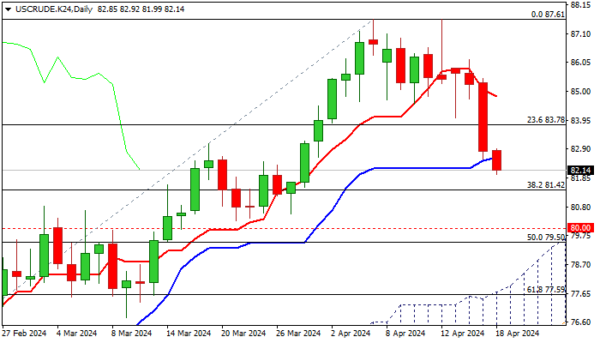

Initial reversal signal is developing on daily chart, as price broke below daily Tenkan-sen and Kijun-sen lines, pressuring pivotal Fibo support at $81.42 (38.2% of $71.40/$87.61 upleg), violation of which to risk extension towards key supports at $80 zone (psychological / converged 55/200 DMA’s).

Weakening daily studies (10/20DMA’s turned to bearish setup and 14-d momentum broke into negative territory) support the action however, bears may face headwinds en-route to $81.42 target on oversold conditions.

Upticks should be capped under $84.00 resistance zone (broken Fibo 23.6% / 20DMA) to keep fresh bears in play for possible deeper correction.

Fundamentals are likely to remain oil’s key driver and markets will continue to focus on demand and the situation in the Middle East.

Res: 82.77; 83.10; 83.78; 84.15.

Sup: 81.42; 80.80; 80.80; 79.50.