- EURGBP tests uptrend line as it resumes slide

- Risks are tilted to the downside

- But pennant pattern suggests more consolidation

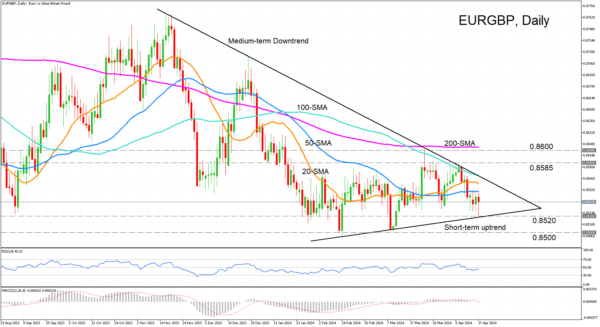

EURGBP has been drifting lower after its latest attempt to break above the medium-term descending trendline failed, peaking at 0.8585. The price briefly touched the short-term uptrend line just below 0.8520 earlier today before bouncing higher.

But as it remains below its 20- and 50-day simple moving averages (SMA), the risks are tilted to the downside, and this is supported by the momentum indicators. The RSI is hovering below the 50 neutral level, while the MACD is still in negative territory below its red signal line.

Should the price spike lower again and break below the downtrend line, attention will likely turn to the 0.8500 level, after which the path is clear until the 0.8400 mark. A drop below the February trough of 0.8496 would signal the resumption of the medium-term downtrend.

However, if EURGBP manages to clear its immediate upside hurdles, which consist of the 50-, 20- and 100-day SMAs, this would help shift the medium-term outlook to a more positive one. But overcoming the 100-day SMA, which is converging with the descending trendline, could prove difficult, while a further climb above the 200-day SMA, slightly above 0.8600, is vital for a more sustainable uptrend.

Overall, despite the bearish bias, the price action could continue to develop within what appears to be a pennant pattern, and this opens the prospect of an upside breakout in the near term.