- Overbought signals persist as USDJPY approaches the 155.00 level

- Bullish trend expected to hold strong above 151.00

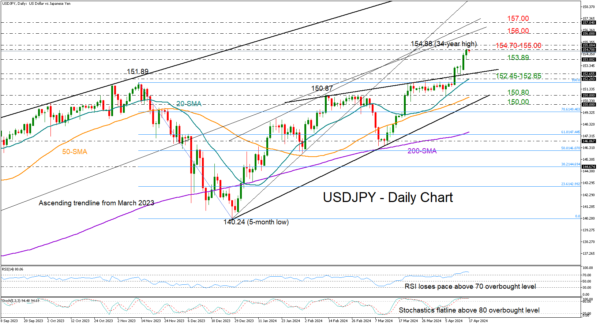

After an explosive bullish session on Monday, USDJPY is now a short distance below the 155.00 psychological level, recording its sixth consecutive week of gains and reaching its highest level since May 1990.

The RSI and the stochastic oscillator are currently losing momentum in the overbought region, flagging a potential slowdown in the market. Due to the substantial price increase in the past week, Japan may consider intervening in the FX market.

However, the daily chart continues to show a strong positive trend, indicating a potential upward continuation.

Beyond the 155.00 number, the pair could experience resistance near the trendline zone of 156.00-157.00, a break of which could cause an acceleration towards the 159.10 territory. The latter overlaps with the 161.8% Fibonacci extension of the November-December downleg.

On the downside, traders might initially pay attention to Tuesday’s low of 153.89. A step below that floor could motivate an extension towards the broken resistance line at 152.65, and the 20-day simple moving average (SMA) at 152.45. Should the sell-off strengthen below 150.80-151.00, the short- and medium-term outlook would shift to neutral, potentially leading to a target around the ascending trendline at 150.00 taken from December’s lows.

Overall, the risk of Japan intervention and the persisting overbought conditions in the market could lead to a loss of impetus for USDJPY in the upcoming sessions. Still, any slowdown would not affect the positive trend in USDJPY unless the bears sink the price below 150.80.