- WTI oil futures step on 84.69 once again, hold near recent highs

- Technical indicators show some weakness, but trend signals are positive

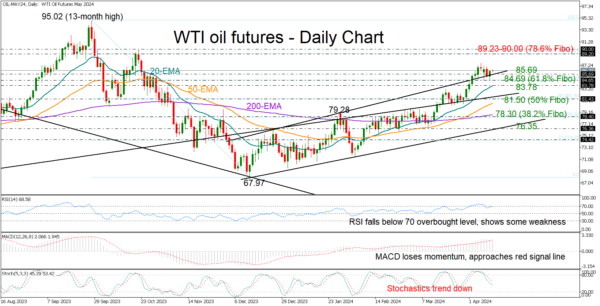

WTI oil futures kept their footing on the 61.8% Fibonacci retracement of the September-December downtrend at 84.69 on Wednesday and closed the day with mild gains at 86.24 after news that Iran may retaliate against Israel’s deadly attack on a diplomatic compound in Damascus.

Although the price has gently bounced back, short-term risks persist as the RSI has left the overbought zone and is leaning to the downside, while the MACD and stochastic oscillator are still trending downwards. On the other hand, the market trend shows a positive trajectory in the 2024 picture and the bullish crosses between the upward-sloping SMAs reaffirm the ongoing upward trend.

Technically, for the uptrend to continue, the price must stay resilient above the upper boundary of the bullish channel at 85.69. A possible rebound there could take the price towards the 76.8% Fibonacci level of 89.23 and the psychological level of 90.00, where the price peaked in October. Surpassing that area, the bulls could advance towards September’s top of 95.00.

If the latest pullback extends below the 20-day SMA at 83.78, support could initially emerge near the 50% Fibonacci level of 81.50, where the constraining ascending line from the pandemic low is positioned. The 50-day SMA is also converging towards that region, while lower, the 200-day SMA and the 38.2% Fibonacci number of 78.30 could postpone a test near the channel’s lower band at 76.35.

Overall, there is a risk that WTI oil futures exhibit some weakness in the coming sessions, but the absence of concerning signs in the positive market trend suggests any downside correction may be short-lived.