Key Highlights

- GBP/USD failed to surpass 1.2700 and declined heavily.

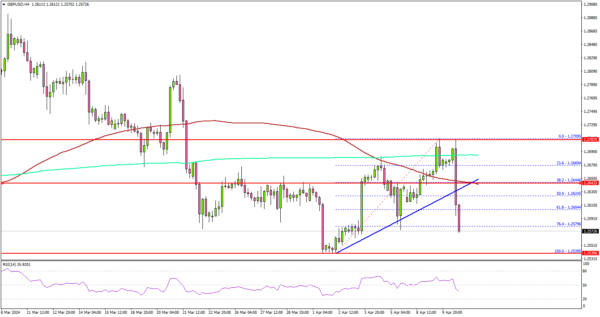

- It traded below a key bullish trend line with support at 1.2630 on the 4-hour chart.

- The US CPI increased by 3.5% in March 2024 (YoY), whereas the market expectation was 3.4%.

- The US Initial Jobless Claims could decline to 215K from 221K.

GBP/USD Technical Analysis

The British Pound failed to continue higher above 1.2700 against the US Dollar. GBP/USD started another decline and traded below the 1.2620 support.

Looking at the 4-hour chart, the pair traded below a key bullish trend line with support at 1.2630. There was a sharp decline after the US CPI report was released, which increased by 3.5% (market expectation was 3.4%) in March 2024 (YoY).

GBP/USD dived below the 50% Fib retracement level of the upward move from the 1.2539 swing low to the 1.2709 high. It is now trading well below the 100 simple moving average (red, 4-hour) and the 200 simple moving average (green, 4-hour).

Immediate support is near the 1.2540 level. The next major support is at 1.2500. If there is a downside break below the 1.2500 support, the pair could decline toward the 1.2465 support. Any more losses might send the pair toward the 1.2420 level in the near term.

On the upside, the pair is facing hurdles near 1.2600. The first key resistance is near the 100 simple moving average (red, 4-hour) at 1.2650.

A clear move above the 1.2650 resistance could send the pair further higher. In the stated case, GBP/USD could rise toward the 1.2700 level.

Looking at Gold, the price reacted to the downside from the $2,360 resistance zone after the US CPI report. However, the bulls were active near the $2,320 level.

Economic Releases

- US Initial Jobless Claims – Forecast 215K, versus 221K previous.

- US Producer Price Index July 2024 (YoY) – Forecast +2.2%, versus +1.6% previous.