The dollar index is trading within a narrow range for the second consecutive day, as traders await release of the US inflation report for March, which is expected to provide more hints on the Fed’s policy outlook.

Widely expected start of cutting rates in June, as well as the pace and size of rate cuts, was questioned after a strong labor report last Friday.

Markets raised bets about keeping rates further on hold, with today’s CPI data to make the picture more clear.

Majority of markets observers believe that US inflation will rise again in March, which will cool expectations for June cut and provide fresh boost to the US dollar.

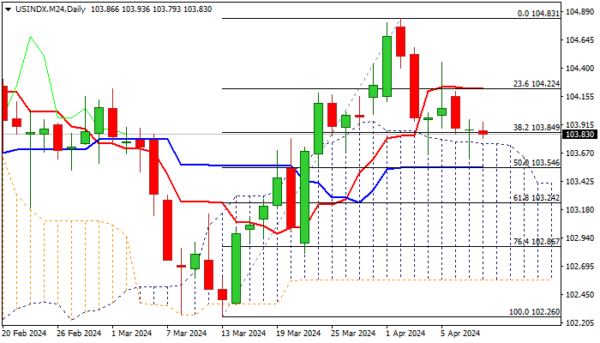

In such scenario, the dollar would jump and generate initial signal of an end of correction from 104.83 (Apr 2 high), with formation of a higher base at 103.65 zone.

Conversely, March data in line or below consensus would add to June rate cut bets and increase pressure on the US dollar.

Top of thick daily cloud offers immediate support at 103.74, guarding lower pivot at 103.55 (daily Kijun-sen / 50% retracement of 102.26/104.83), while daily Tenkan-sen (104.22) marks an upper trigger.

Res: 104.10; 104.22; 104.45; 104.83.

Sup: 103.74; 103.55; 103.24; 103.00.