- EURUSD pulls back from two-week high

- Technical bias is not bearish yet

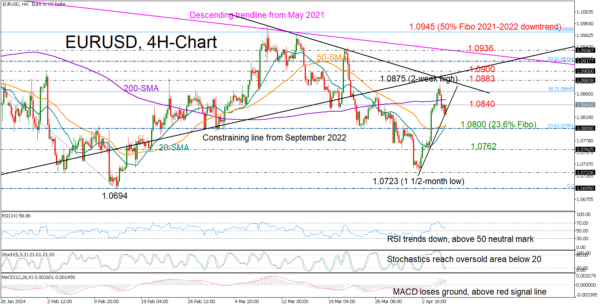

EURUSD gave up some ground on Thursday after a sharp rally from a one-and-a-half-month low of 1.0723 to a two-week high of 1.0875.

The US nonfarm payrolls report is on the agenda today and investors will look at whether jobs growth slowed down to 212k and wage growth eased to 4.1% y/y as forecasts suggest. The pair might receive some assistance if there are indications of a weakening US labor market, and the near-term technical outlook cannot exclude a shift to a recovery phase.

Both the RSI and the MACD are sloping to the downside, but the former is still above its 50 neutral mark and the latter has yet to cross below its red signal line. Moreover, the stochastic oscillator has already reached its 20 oversold level, suggesting that the bearish action in the price might halt soon.

Adding to the encouraging signals is the progressing bullish cross between the 20- and 50-period simple moving averages (SMAs). The completion could maintain investors’ confidence in the recent positive turnaround.

The support trendline drawn from the lows of this week is currently buffering downside forces around 1.0825, but traders are hoping for a close above the 1.0840 level, where the 20-SMA is placed in the daily chart, to refocus on the descending trendline from March at 1.0884. Breaking above the latter could result in an immediate pause near the psychological level of 1.0900. If not, the recovery could speed up to 1.0935, where the long-term resistance line from May 2021 is positioned.

Should the price drop below 1.0825, the 20- and 50-period SMAs may offer assistance around 1.0800. A continuation lower could initially pause around 1.0780 and then near 1.0760, while a deeper move could set the stage for another battle near the 1.0723 low.

Briefly, EURUSD has started a new negative cycle, but the short-term bias hasn’t shifted to the bearish side yet. Nevertheless, a close above 1.0840 will be needed to restore buying interest.