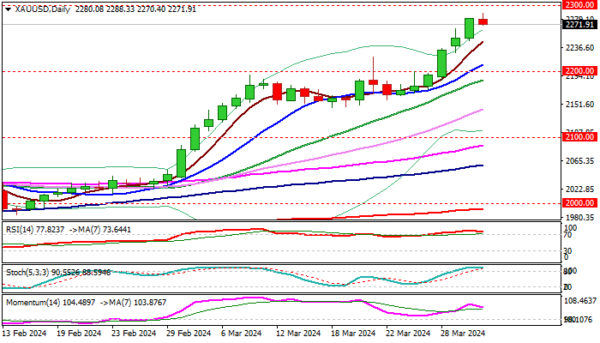

Gold edges lower from new record high ($2288) in early Wednesday, as bulls show signs of fatigue after advancing over 5% in a steep acceleration in past six days.

Although the metal resumed the uptrend in early April, after an impressive 9.3% rally in March, remaining strongly underpinned by growing signals of Fed’s first rate cut in June and geopolitical tensions, corrective action in the near term cannot be ruled out.

Profit taking after latest rally may spark fresh dips, as stretched technical studies on all larger timeframes (day / week / month) have already sent initial warnings that bulls may face increased headwinds on approach to psychological $2300 resistance.

Larger picture remains firmly bullish, adding to scenario of a healthy correction, which will give bulls space to consolidate before broader uptrend resumes.

Initial supports lay at 2222 (former top/daily Tenkan-sen)) and $2211 (rising 10DMA) with extended pullback expected to find firmer ground at $2200/$2180 zone (psychological/20DMA) to keep bulls intact.

Res: 2288; 2300; 2359; 2400.

Sup: 2222; 2211; 2200; 2187.