- Gold advances sharply in the past few sessions

- Extends its streak of new all-time highs

- Momentum indicators suggest overbought conditions

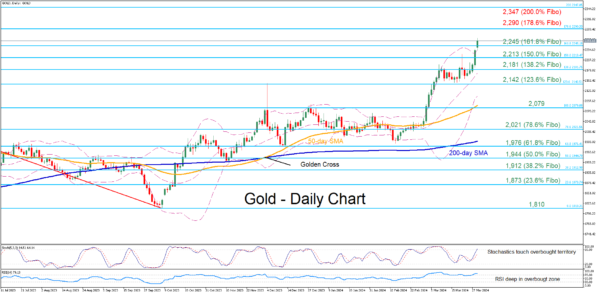

Gold has experienced a massive surge following its profound break above the 50-day simple moving average (SMA) in the beginning of March, generating a series of fresh record highs. However, an impending pullback could be on the cards as the short-term oscillators are flagging overbought signals.

Should the rally persist, the price could resume its movement within uncharted waters, where the Fibonacci extensions of the 2,079-1,810 downtrend may provide potential upside hurdles. Hence, the bulls could initially attack the 178.6% Fibo of 2,290 ahead of the 200.0% Fibo of 2,347. Failing to halt there, bullion might encounter resistance at the 2,500 round number.

In case of a pullback, gold may slide towards the 161.8% Fibo of 2,245 before the 150.0% Fibo of 2,213 comes under scrutiny. A violation of the latter might pave the way for the 138.2% Fibo of 2,181. Furter declines could then stall around the 123.6% Fibo of 2,142.

In brief, gold has been surging to consecutive all-time highs in the past few sessions, trading even above its upper Bollinger band. Therefore, the risk of a downside correction is growing given that technical indicators are warning of an overstretched advance.