Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

AUDCHF – D1 Timeframe

AUDCHF as seen in the daily timeframe chart above, has just bounced off the pivot zone, with a likely retest having been completed as well. Considering the bearish array of the moving averages and the supply zone within the pivot region, I am inclined to tilt my sentiment in favour of the bears in this case.

Analyst’s Expectations:

- Direction: Bearish

- Target: 0.57683

- Invalidation: 0.59481

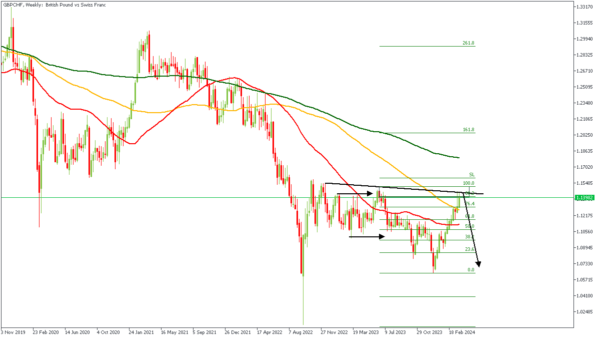

GBPCHF – W1 Timeframe

GBPCHF on the weekly timeframe seems to have printed a solid QMR pattern. We’ve seen an area of accumulation (bounded by the two horizontal arrows), as well as the distribution and now I believe the correction of the distribution is at its end. The confluences for this trade are; the bearish array of the moving averages, the 88% of the Fibonacci retracement level, trendline resistance, the QMR pattern, as well as the rally-base-drop supply zone.

Analyst’s Expectations:

- Direction: Bearish

- Target: 1.09891

- Invalidation: 1.15292

CADCHF – W1 Timeframe

The prevalent trend on CADCHF is quite clearly bearish. We can as well see the confluence of the trendline resistance and the rally-base-drop supply zone. The Fibonacci retracement level and the bearish array of the moving averages provide additional confirmation of a bearish sentiment.

Analyst’s Expectations:

- Direction: Bearish

- Target: 0.65454

- Invalidation: 0.68378

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.